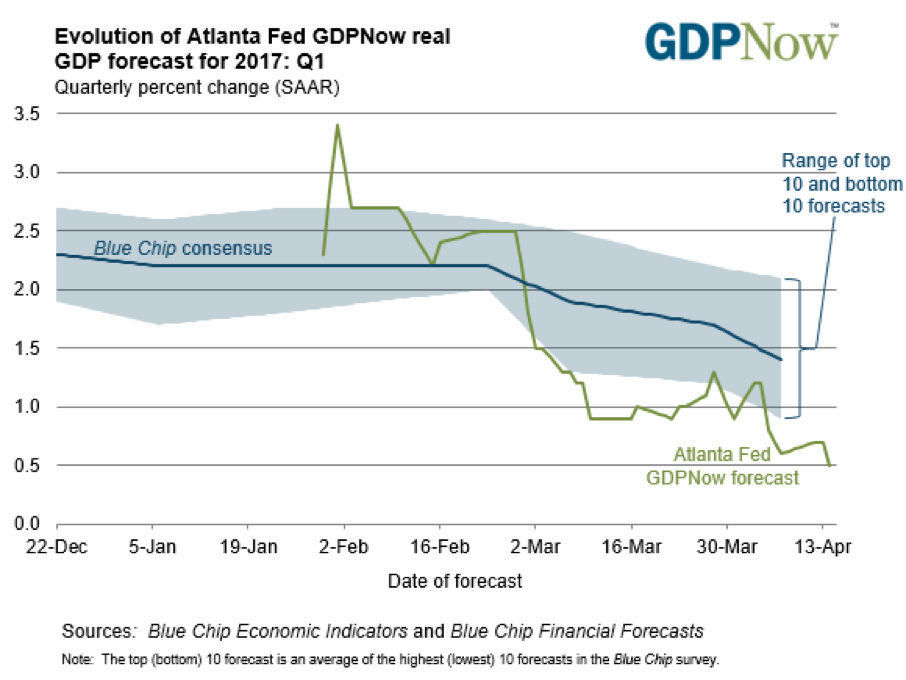

While U.S. markets were closed for Good Friday and investors were largely preoccupied with geopolitical happenings, something big happened on the economic front: A batch of very poor "hard data" — in contrast to the ongoing strength in survey-based "soft data" — pushed the Atlanta Fed's GDPNow estimate of first-quarter growth to just 0.5 percent, the lowest in three years.

The previous day, the Dow Jones Industrial Average fell away from its 50-day moving average, a key measure of medium-term strength, marking the first major downtrend initiation since last September.

Suddenly, the post-election "reflation" trade that pushed stocks to fresh highs appears to be ending.

Related: What Will It Take to Finally Get US Workers’ Pay Growing Again?

The decline in the GDP forecast is pretty incredible: Just two months ago, the Atlanta Fed was looking for 3.4 percent growth. And the downward trend there stands in stark contrast to the bright confidence being displayed by consumers, policymakers and investors.

Consumer sentiment, as measured by the University of Michigan, is just a hair away from the record high set in the middle of the dot-com boom in 1999. The Federal Reserve has raised interest rates twice since December, is threatening another two or three quarter-point hikes this year and is openly talking about reducing its asset holdings later this year (beginning the process of reversing multiple quantitative easing bond-buying programs).

Related: Will Unwinding the Fed’s $4.5 Trillion Balance Sheet Kill the Bull Market?

Meanwhile, investors have pushed stock prices higher despite a stalling of economy-wide measures of corporate profits, pushing cyclically adjusted price-to-earnings valuations to levels that have only been exceeded in the runup to the 1929 and 2000 bubble markets.

To put this in perspective: If the 0.5 percent estimate is accurate, it would represent the weakest quarter of economic growth in which the Fed tightened policy in 37 years.

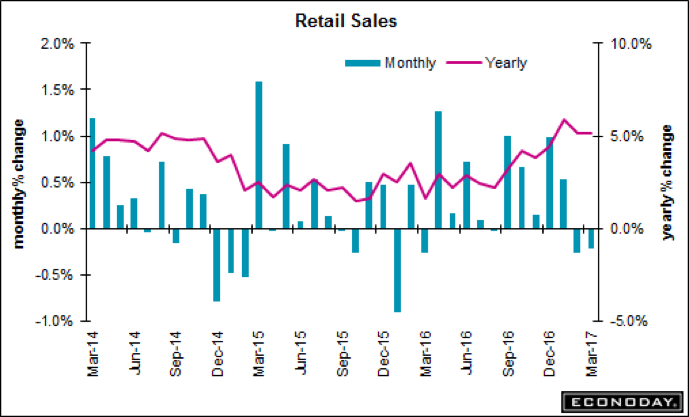

The decline in the Atlanta Fed’s measure was driven by a weaker-than-expected retail sales report, suggesting consumers, while feeling confident, are either unwilling or unable to increase their actual spending. For the second consecutive month, retail sales declined on a monthly basis with a -0.2 percent drop in March when no change was expected. Vehicle sales suffered a third straight drop, down 1.2 percent.

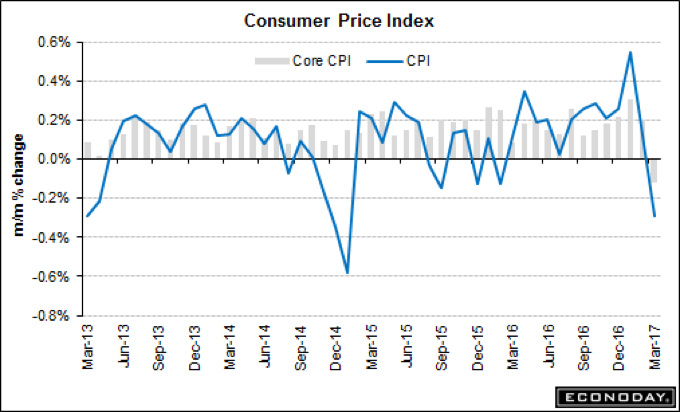

Adding to the dour economic outlook has been a surprise pullback in inflation data: The Consumer Price Index dropped 0.3 percent in March, when no change was expected, pulling the annual rate to 2.4 percent as "base effects" from the early 2016 wipeout in oil prices have now been now fully lapped.

Related: The Key to This Market — Here’s What Will Determine if Stocks Rise or Fall

The avalanche of bad news calls into question all the assumptions and expectations that drove the post-election uptrend. Moreover, political gridlock in Washington has made any action on tax cuts and stimulus spending increasingly a 2018 story as the Trump administration instead refocuses on health care reform and grows increasingly preoccupied with foreign policy hotspots.

Wall Street is quickly working to change tack. Long-term Treasury bonds are getting strongly bid. The U.S. dollar is weakening. Gold is on the move. And bank stocks, shown below, are threatening to fall out of a massive five-month topping pattern as represented by the Financial Select SPDR (XLF).

Given how far stocks quickly ramped following Trump's surprise electoral victory, they have far to fall before resetting sentiment. The Dow's 200-week average was last touched in February 2016 and is now at 17,387 — which would be a 15 percent decline from the current level.