For years, stocks have been driven relentlessly higher thanks to a single statement that summarized the aggressive central bank largesse since the eurozone crisis flared up in 2012: Policymakers would do "whatever it takes" to get inflation and employment higher.

Each scare that seemed ready to rattle markets was rapidly dismissed: Ebola. Brexit. President Trump. Stocks powered through each time, backstopped by the true faith the central banks would keep the situation under control.

But over the past few weeks, these assumptions have been challenged. The Federal Reserve has become increasingly hawkish as it grows concerned about its "third mandate" of financial stability in the face of stock market valuations that have gotten extreme. The European Central Bank rattled global bond markets by forcefully stating the risk of deflation had passed and that reflation was in play.

Related: Is the Fed Fighting the Trump Rally?

Now Bank of America Merrill Lynch analysts are wondering aloud: Are the central bankers about to turn the screws on Wall Street and the wealthy who have benefited from the asset price gains of recent years?

The commentary from Fed officials has been striking. Last Tuesday, both Fed Chair Janet Yellen and Vice Chair Stanley Fischer noted extended asset price valuations and financial system leverage. San Francisco Fed President John Williams said he was "concerned about the complacency in the market" and that the "stock market still seems to be running very much on fumes."

Fischer added that "equity P/E ratios are near the top of historical levels" and that it would be "foolish to think all risks [are] eliminated" amid a "notable uptick in risk appetites in asset markets."

In addition to the Fed, the Bank for International Settlements, the Bank of England and the European Central Bank have all recently highlighted financial stability concerns while measures of the eerie calm in financial markets hover near record highs.

Related: Six Risks That Should Make Stock Market Bulls Nervous

It is in this context that BofAML's chief investment strategist Michael Hartnett thundered in a note to clients last week that this was "No Market for Rich Men" and that the Federal Reserve and the European Central Bank were "now tightening policy to make Wall St. poorer." He is calling for a "big top" in stocks sometime this autumn, leaving just a few more months in the rally the market bulls have grown to know and love.

The key change is that the flow of global central bank purchases is slowing rapidly: From $350 billion in April to $300 billion in May to less than $100 billion in June. The Federal Reserve is on track to start selling, on net, as soon as September as it looks to reduce its $4.4 trillion balance sheet. The minutes of the Fed’s June policymaking meeting, released Wednesday, show that several officials “preferred to announce a start to the process within a couple of months.”

Hartnett’s advice: Get back into big-cap tech stocks for one final push higher, but prepare for the looming downside in stocks and upside in long-term yields by reducing exposure to credit, buying volatility and avoiding emerging market debt and high-yield.

Related: The Federal Reserve Bank, Explained

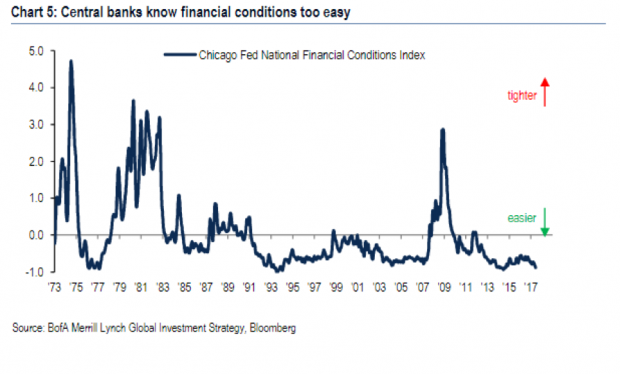

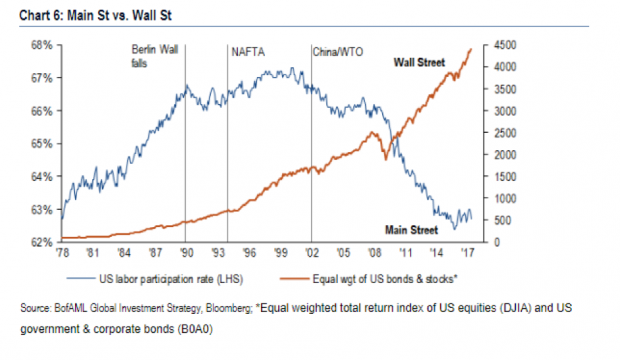

The motivation for the change in tack by central bankers? The desire to increase volatility. Financial conditions are too easy (shown above), increasing the risk of overheating and inflation when U.S. unemployment is at just 4.3 percent. But the Fed’s urgency is also an acknowledgement that it has worsened the inequality gap, as cheap money policies have overwhelmingly favored the rich over the working poor (shown below).

The cynic in me wonders why Fed officials are suddenly worried about risks to financial stability now that we seem to finally be on the cusp of wage inflation and thus lower growth in corporate profitability. Is this truly a declaration of war on the rich? Or are the central bankers pulling the plug just as Middle America was about to get its fair share?

Related: Fed Staff Forecasts From FOMC Minutes

Hartnett warns this won't end well. The Fed and ECB are tightening amid a lack of inflation at a time when global debt has hit a record high of $217 trillion (327 percent of global GDP), according to the Institute of International Finance. Higher interest rates and bond yields will increase credit service costs, leading to increased defaults and market chaos resulting in "radical fiscal stimulus, trade war, major increases in geopolitical risk, Occupy Silicon Valley policies" and more.