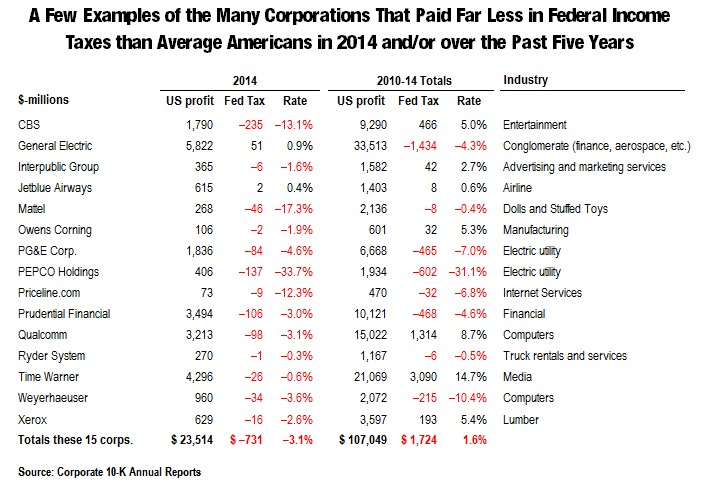

Amid calls for a major overhaul of the federal tax system, a new study shows that 15 major Fortune 500 companies avoided paying taxes on $23 billion in profits in 2014.

Moreover, these companies -- including CBS Corporation, Mattel, Prudential and Ryder System -- paid almost no federal income tax on $107 billion over the past five years.

Related: Ryan Shoots for Tax Reform within Seven Months

According to the study by Citizens for Tax Justice, all but two of the companies received federal tax rebates last year. And almost all paid exceedingly low effective tax rates over five years.

There was nothing illegal or improper about what these companies did. They were merely taking advantage of major corporate tax loopholes and provisions long part of the fabric of the U.S. tax code.

“While recent policy discourse has focused on multinational corporations that use offshore tax havens to minimize their tax liability, the companies profiled here appear to be using a diverse array of other tax breaks to zero out their federal income taxes,” the new study stated.

For instance, Jetblue, PG&E, PEPCO Holdings and the Ryder truck rental service all used accelerated depreciation, a tax break that allows companies to write off the cost of their capital investments much faster than these investments wear out, to dramatically reduce their tax rates. CTJ estimated that closing the popular accelerated depreciation loophole could raise more than $428 billion for the government over the next decade.

Related: How Tax Reform Could Help Save U.S. Infrastructure

Priceline relied heavily on a single tax break — writing off the value of executive stock options for tax purposes — to zero out its tax liability. Qualcomm has enjoyed more than $290 million in research and development tax breaks over the past three years.

“As Congress focuses on strategies for revamping the U.S. corporate income tax, a sensible starting point should be to critically assess the costs of each of these tax breaks and to take steps to ensure that profitable corporations pay their fair share of U.S. taxes,” the study stated.

The Obama administration and House and Senate Republican leaders have repeatedly voiced interest in corporate tax reform this year to spur economic growth by reducing excessive tax rates, eliminating costly loopholes and encouraging multinational corporations to pay taxes on profits currently being sheltered overseas.

In mid-February, Rep. Paul Ryan (R-WI), the new House Ways and Means Committee chair, laid out an ambitious agenda for his tax-writing and fiscal policy committee for the coming two years -- including what he hopes will be the first big phase of comprehensive tax reform by late summer. .

Related: 10 Big Corporate Tax Breaks, and Who Benefits

“My guess is that tax reform is a 2015 thing for sure and has to be done by summer,” Ryan told reporters.

Both Ryan and President Obama have raised the possibility that Congress could find ways to use tax reform to help fund long-term highway and other infrastructure programs.

Sen. Bernie Sanders (I-VT), the ranking member of the Senate Budget Committee, praised the Citizens for Tax Justice report for “revealing the unfairness of our tax system and the fact that a number of the biggest and most well-known corporations in America continue to pay little or nothing in taxes.”

Related: Smart Tax Reform Has to Account for This Massive Change

“At a time when we have massive wealth and income inequality, and when corporate profits are soaring, it is an outrage that many large, profitable corporations not only paid nothing in federal income taxes last year, but actually received a rebate from the IRS last year,” Sanders added.

All 15 companies’ effective federal income tax rates for 2014 and the five-year period between 2010 and 2014 are shown in the table below:

Top Reads from The Fiscal Times: