With the holiday season upon us, Congress and the White House are once again engaging in the ritual of parceling out tens of billions of dollars in tax breaks and other goodies to just about every conceivable interest group – from well-heeled corporate executives and film producers to rum makers, horse breeders and just plain Americans looking for a tax break or two.

Related: 5 Outrageous Tax Breaks Congress Is Preparing for Special Interests

The process rarely draws much attention and lacks the political sex appeal of major tax reform or monster spending bills that sometimes lead to epic showdowns or even government shutdowns.

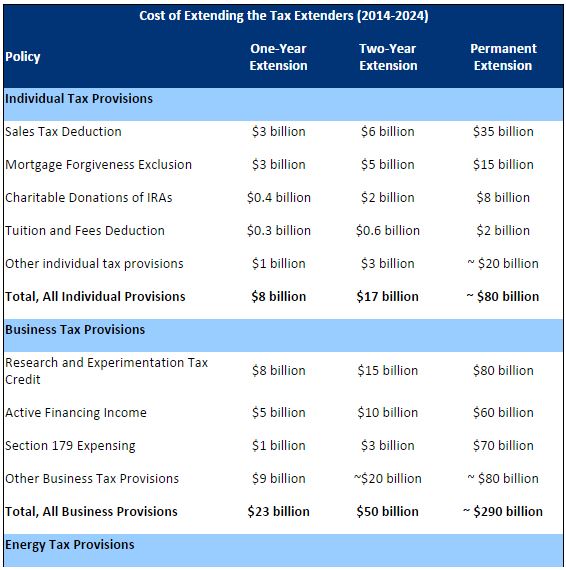

Instead, lawmakers and the administration will be wrestling with decisions on the fate of 55 or so highly obscure but often extraordinarily costly tax breaks that lapsed at the end of 2014 and must be reauthorized retroactively for the 2015 tax year. GOP House and Senate leaders will make a big push soon to try to work out a two-year compromise with the White House before the Christmas recess.

None of the measures are part of the permanent federal tax code and therefore must be renewed every year or two. For that reason, they are called tax “extenders,” although they could be viewed more colorfully and perhaps more accurately as generous gifts in wrapping paper under the Christmas tree. Congress last handled this chore in December 2014.

These tax rules range in quality from the very serious – such as business research and development tax credits and tuition fee reductions -- to the frivolous or even ridiculous, including tax breaks for NASCAR track owners and write-offs for film and television producers.

The one thing they all have in common, however, is that they aren’t paid for. As much as Republican and Democratic members of Congress wring their hands over the federal deficit and the massive national debt, when it comes to the many billions of dollars in revenues lost to the tax extenders, they are more than happy to add it to the nation’s credit card. A Senate version of a new two-year extenders bill approved last summer would increase the deficit by $87 billion over the coming decade, according to the Congressional Budget Office.

Related: Congress Is Already Making Next Year’s Tax Season More Confusing

Just like spending on the war in Afghanistan, Iraq and now Syria, lawmakers don’t bother to try to find offsetting cuts in entitlement programs or other tax provisions to make their exercise “budget neutral” – a source of consternation to many government spending watchdog groups such as the Committee for a Responsible Federal Budget and Taxpayers for Common Sense.

“We should be reforming the tax code to make it more competitive, not simply extending tax breaks year after year,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget. “With debt already at record high levels, it is absolutely the wrong time for policymakers to pass tax cuts that further add to the debt.”

One of the budget organization’s pet peeves is with the so-called “bonus depreciation,” an incredibly costly measure that the government used several times during the Great Recession but that seems superfluous and extravagant since the recovery.

The bonus depreciation allows businesses to write off 50 percent of the cost of capital investments immediately while the rest is deducted more gradually over time. Between 2008 and 2014, the bonus depreciation has cost the Treasury roughly $200 billion, including interest, and it will cost even more if it is reauthorized retroactively for the 2015 tax year.

Related: The Next Debt Crisis Could Be Much Worse than 2013, GAO Warns

Yet Republican lawmakers have even bigger plans for the bonus depreciation. They want to make it permanent, along with the research and experimentation tax credit, a favorable expensing provision for small businesses, certain charitable deductions and a deduction for state and local taxes.

If the bonus depreciation is made permanent, the Committee on a Responsible Federal Budget warns it would cost overall nearly $450 billion through 2025. The other tax breaks made permanent would drain the Treasury of tens of billions of dollars more in just the next couple of years.

The White House and congressional Democrats are resisting such a move, according to Washington policy experts familiar with the talks. The Democrats are threatening to block making those business tax breaks permanent unless the Republicans also agree to enhance the benefits under the Earned Income Tax Cred and Child Tax Credit and make them permanent as well.

Millions of working families each year claim the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC), which have helped lift 31.7 million people above or closer to the poverty line in 2013. However, adults without children and non-custodial parents have been left out, and the Democrats are seeking changes to correct that and other problems. According to some estimates, converting the two credits to permanent measures would cost roughly $100 billion over the coming decade.

“Saving these provisions deserves bipartisan support,” wrote Bryann DaSilva of the liberal-leaning Center on Budget and Policy Priorities. “Policymakers are expected to try to permanently extend several corporate tax breaks before year’s end. As they consider which expiring tax provisions to make permanent, they should accord top priority to these important EITC and CTC provisions.”