As the markets continue their late-year roller-coaster ride, investors are starting to make portfolio moves — and that could end up costing them in the long term.

Nearly three-quarters of investors expect the market swings to continue in 2016, according to a new Wells Fargo/Gallup survey, with 16 percent expecting high volatility. Among those who expect volatility, 44 percent are getting in touch with their financial advisors, 30 percent plan to buy stocks at low prices and 15 percent are selling to protect against losses.

Related: Don’t Look Back in Anger — 10 Market Milestones of 2015

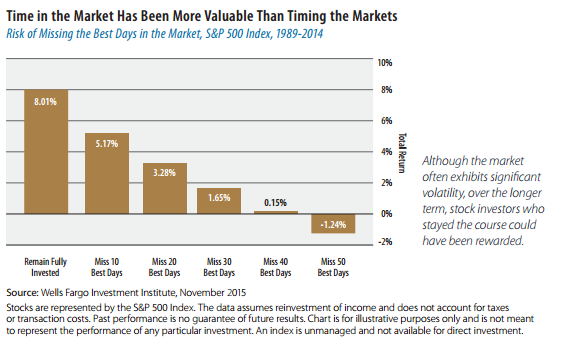

For small investors, however, trying to time the market is rarely a winning strategy. A J.P. Morgan Chase analysis looked at the 10-year period from 1995 to 2015 and found that six of the 10 best market days occurred within 10 weeks of the 10 worst days. Investors who sold and sat out during those periods of volatility would have missed out on profits those days.

An investor who kept $10,000 fully invested during that period would have $65,453 after the 10-year period, while one who missed the 10 best days would have about half that. Ouch.

Riding out the rough patches isn’t easy, of course, but having a plan in place can at least help you sleep easier. “The market could be in for a bumpy ride, which is why it’s as important as ever for investors to have a strong financial plan that keeps them on track with their goals and risk tolerance,” Wells Fargo Advisors director of advice Zar Toolan said in a statement.

More than half of investors surveyed claim to have a moderate risk tolerance, meaning that they worry “only a little” about a 5 percent to 10 percent market downturn. A quarter of investors claims a high risk tolerance and don’t worry at all, and 18 percent report having little or no risk tolerance.

Nearly three-quarters of those surveyed said that their portfolio matched their risk tolerance — a good sign that the churn in the markets won’t induce similar churn in their stomachs.

Financial advisors generally recommend creating a portfolio asset mix that matches your risk tolerance and then maintaining that investment strategy during times of volatility. Some also suggest that the ups and downs of the market can present good opportunities, so it’s worth mapping out any portfolio changes you might want to make or discuss them with your advisor.