With millions of college students and their families struggling to cope with mounting costs for tuition and room and board, new research suggests that the staggering $1.34 trillion of annual student debt has a significant “racial” as well as economic dimension to it.

The average cost of tuition and fees for the 2015-2016 school years was $32,405 at private colleges, $9,410 for state residents in public universities and colleges and $23,893 for out-of-state students attending public universities, according to College Board. At the same time, debt taken on by students and their families increased by $2,726.27 every second, according to Market Watch.

Related: How You Can Escape Student Loan Repayment

While families across the socio-economic spectrum have been forced to borrow more and more in recent years to keep up with the mounting costs of attending public, private and for-profit colleges and universities, “minorities in the course of financing a college degree can differ substantially from those faced by whites of similar economic and educational standing,” according to Richard V. Reeves, a senior fellow in economic studies at the Brookings Institution.

Reeves wrote that the so-called “race gap” in higher education loans and debt turned out to be much wider than previously assumed, in light of new research published last week by Children and Youth Services Review.

Previous studies documented “significant variations” in the level of debt by race and household income, with blacks and lower-income students not surprisingly accumulating more in debt than their white and upper-income peers. But those earlier studies said little about disparities in debt within the cohort of minorities and lower income families.

“Evidence now demonstrates significant variation in education-debt levels by race and household income, with black and lower-income students accumulating higher levels of education debt compared to their white and upper-income peers,” according to the Children and Youth Services Review study.

Related: Guess Who in Congress Has $100,000 in Student Loans

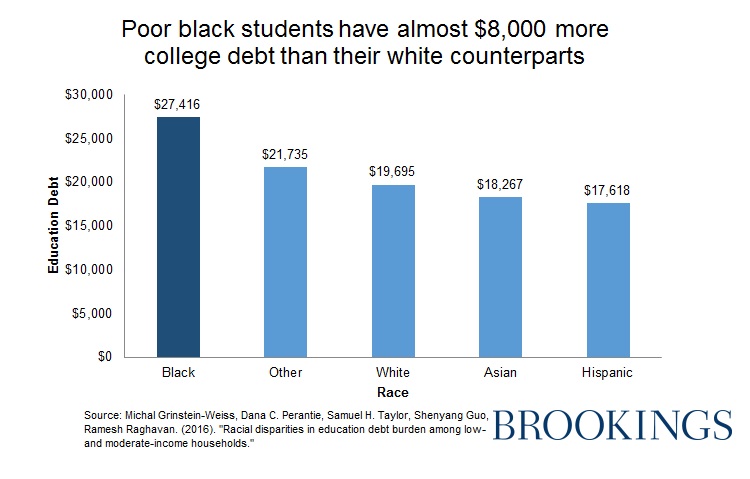

Indeed, the study found that low-income black students take on an average of $7,721 more in education debt than low-income white students and their families who face similar liquidity and borrowing challenges. What’s more, this disparity persists long after graduation.

Reeves writes that black and Hispanic students “are both more likely to take on debt and to take on more debt” than white and Asian students. Asian students, in fact, are 40 percent less likely than their white counterparts to borrow to attend school.

“The result is a significant race gap in overall student-debt burdens,” according to Reeves. “The black-white gap for low and middle income respondents is estimated to be $7,700, a disparity about twice as wide as that found in previous studies.”

Here’s a chart that tells part of the story:

So why is the racial debt gap so substantial, even after adjusting for income differences? Reeves offers a couple of possible explanations:

One is cultural. Even though they may come from similarly low or moderate income families, white and Asian students may be able to count on greater economic support from their families than can black students. Another recent study concluded that black students receive less help paying for the schooling from parents than do white students in the same income groups.

“It’s also possible that there are different attitudes toward taking on debt between people in particular racial categories,” Reeves wrote.

Related: Here’s Why It Takes Women Longer to Pay Off Student Loans

Another explanation goes to the quality of students’ post-secondary education and the types of colleges and universities they ultimately apply to and attend. In particular, blacks and Hispanic students from lower-income families “are more likely to attend for-profit schools, which are poor value for money by comparison to state schools and other colleges,” Reeves wrote. Some for-profit schools have highly checkered reputation for pressuring their students to borrow more through federal programs for college course work of dubious value.