It’s taken some wild swings over more than a year, but the S&P 500 finally broke through to a new all-time high on Monday, closing at 2,143.16, while the Dow Jones Industrial Average reached a new intraday high on Tuesday.

The new records put a remarkable exclamation point on one of the best stock market rallies in history (though that’s not to say the bull run is over).

Consider that it wasn’t long ago that investors were scrambling to sell, and the fate of the stock market rally looked tenuous. Following the U.K.’s surprising Brexit vote last month, the S&P 500 plunged 5.34 percent. The unexpected outcome of the vote, the downfall of British Prime Minister David Cameron, a possible leadership vacuum in the U.K. and uncertainty over the future of Europe all contributed to investor’s chilly feelings and widespread market downturns.

Related: The Stock Market Is Heading for a Wile E. Coyote Moment

Many of those questions remain — as do plenty of others about the global economy — yet domestic and international stock indexes have rebounded strongly and quickly. Since its tumble, the S&P is up 6.83 percent, for a net gain of more than 1 percent as of Monday’s close. Investor optimism has been buoyed by a strong U.S. jobs report, some renewed political stability across the pond and Japanese Prime Minister Shinzo Abe’s order for new fiscal stimulus.

“This may be one of the most-hated bull markets on record, but it just broke out to new highs in style,” analysts at the Bespoke Investment Group noted Tuesday.

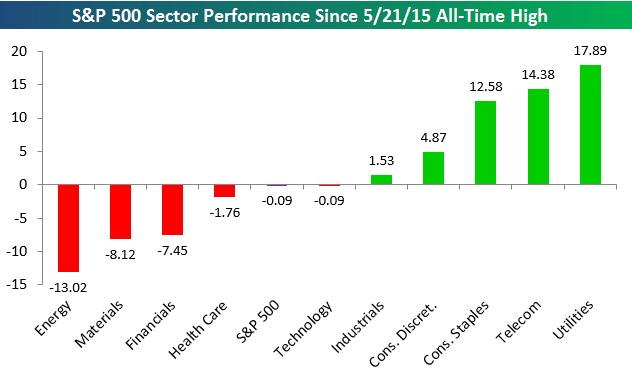

Still, as you can see in the chart below from Bespoke, defensive sectors have led the way since the S&P last reached a new high in May 2015.

Here are a few other numbers to know about the bull market’s run:

$18.52 trillion: Market value of the S&P 500 as of July 9, according to data from S&P Dow Jones Indices

88: Months that the bull market has lasted, making it the second longest in history behind only the rally that started in October 1990

$12.6 trillion: Market value added over the course of this bull market (since the market reached a low on March 9, 2009)

$207 billion: Market value added since the Brexit vote

$4.7 trillion: Market value gained since the previous bull market high in October 2007

109: New S&P 500 closing records set during this bull market

417: Days between the S&P 500 hitting a high in May 2015 and it surpassing that high this week

$4,470,605,000,000: Assets on the Federal Reserve’s balance sheet, up from $869 million in mid-July 2007.