As Donald Trump formally accepted the Republican presidential nomination Thursday, he repeated his oft-cited claim that America is “one of the highest-taxed nations in the world” while touting his plan for steep tax cuts — “the largest tax reduction of any candidate who has run for president this year.”

Trump’s claim might ring true to an American public that doesn’t like sending checks to Uncle Sam and is tired of dealing with a complex, multi-layered tax system, but fact-checkers have called Trump out on this line before. Even a cursory comparison suggests Trump has it wrong.

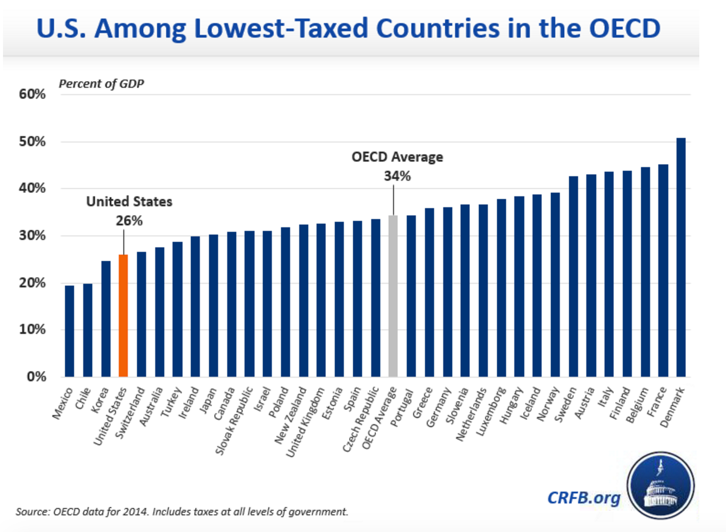

Simply put, the U.S. is nowhere near the highest-taxed country in the world.

Related: Americans Will Spend 8.9 Billion Hours Doing Taxes in 2016

As the Committee for a Responsible Federal Budget (CRFB) points out, there are different ways to measure the tax burden a nation’s population faces. One metric experts like to use is tax revenue as a share of the economy. Using data from the Organization for Economic Cooperation and Development, the CRFB compared the tax revenue of 34 developed countries as a percentage of GDP. The U.S. ranked 31st, with tax revenue (including federal, state and local government taxes) amounting to 26 percent of GDP. Denmark ranked the highest at 52 percent. Only Mexico, Chile and Korea were lower.

Looking at tax revenue per capita, the U.S. ranked 16 out of 34 countries, according to the OECD.

Related: How Fortune 500 Companies Avoid Paying $620 Billion in Taxes

The CRFB also notes that Trump would still be wrong even if he was referring to just the the federal individual income tax rate or the U.S. corporate tax rate. The top U.S. individual federal tax rate is 39.6 percent, below the OECD average of 42.2 percent, according to tax advisory company KPMG. Sweden, Denmark, Japan, Austria, the Netherlands, Australia, China, Germany and the U.K. all have higher tax rates, according to the KPMG list. Similarly, a host of nations have higher income tax rates on low earners.

On the corporate side, the statutory corporate tax rate is 39 percent, including an average of state and local taxes. This figure is the highest among OECD countries studied — so score one for Trump. However, it’s important to take this figure with a grain of salt, as the effective corporate tax rate — the rate businesses actually pay when deductions, credits and loopholes are taken into account — is considerably lower. Martin Sullivan, chief economist and contributing editor for the Tax Analysts Blog, compared five studies of American companies’ effective corporate tax rates and found that they actually paid 5 to 10 percent lower than the statutory tax rate — not far off from the OECD’s unweighted average of 25 percent.