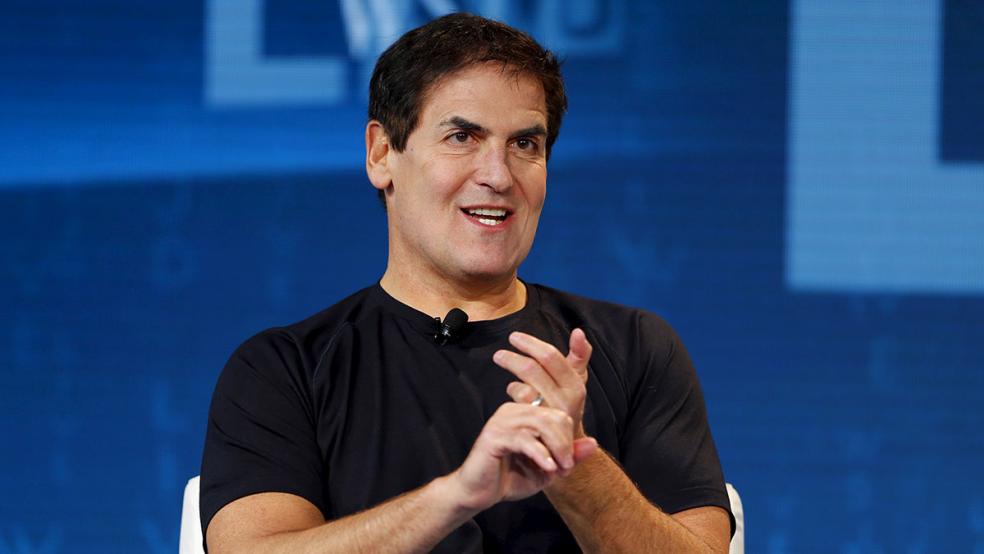

Mark Cuban is bearish on the stock market in the event of a Trump presidency.

In an interview with Fox Business' Neil Cavuto on Tuesday, the investor and reality-TV star said that the uncertainty from a win by Republican presidential candidate Donald Trump would cause a collapse in the stock market.

Related: Here’s Why Mark Cuban Went From Trump Supporter to #NeverTrump

Cuban previously expressed this view, but he reiterated it in Tuesday's interview.

"In the event Donald wins, there is no doubt in my mind the market tanks," Cuban said.

Cuban has not been a fan of Trump for some time, most recently tangling with both the candidate and his lawyer over whether Trump was trustworthy. Cuban has also endorsed Trump's opponent, Democratic nominee Hillary Clinton.

In fact, Cuban said that if Trump were to win, he would "put a hedge on" that is worth "more than 100% of my equity position."

Related: What Donald Trump Can Learn from Mark Cuban

He also expressed concern over the state of the market in general. Cavuto asked Cuban if he was expecting a more tumultuous autumn after the market's quiet summer.

Cuban said that uncertainty and market dynamics have set the stage for a more volatile end of the year.

"There are so many external global influences on our market," Cuban said. "You know, what money comes here when there is uncertainty overseas, what money goes into Treasurys, where does money go if rates go higher or lower?"

Part of this is because of uncertainty about the economic outlook, to which a possible Trump presidency contributes significantly, according to Cuban.

This article originally appeared on Business Insider. Read more from Business Insider:

Trump has vaulted into the lead in a new national poll

The government is trying to figure out how to stop people from cheating Obamacare