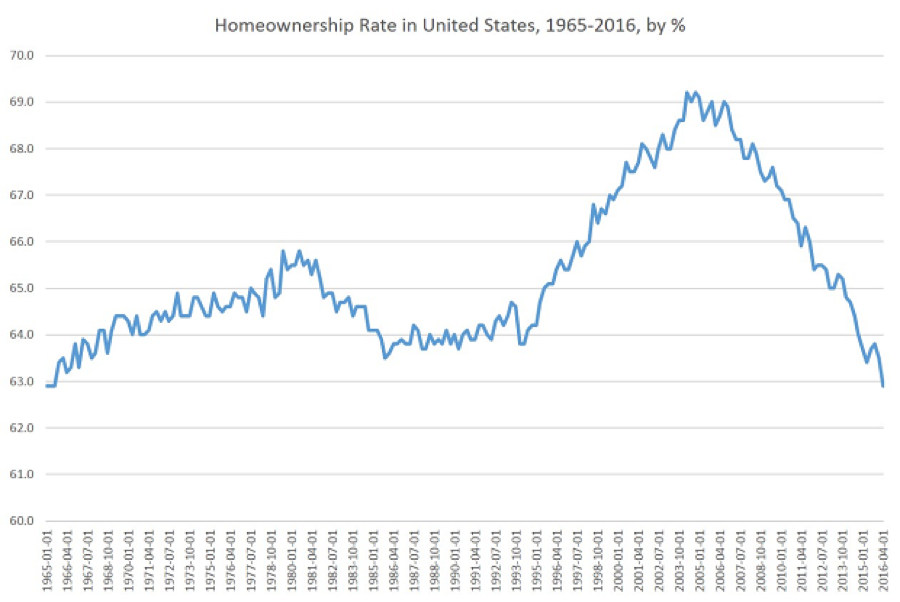

The American homeownership rate is at its lowest point in more than 50 years, but that doesn’t mean that Americans want to live in traditional rentals like apartment and condos. As Millennials finally begin to start families, they’re increasingly looking for single-family homes to rent, and investors are responding to the growing demand.

Even as rising prices push down the returns on single-family homes, investors are buying more of them. Institutional investors (those buying more than 10 properties a year) made up 2.7 percent of all single-family home purchases in the first seven months of 2016, up from 2.1 percent in the same period in 2015, according to a new report from ATTOM Data Solutions. Institutional investment in single-family homes increased in 68 percent of the 500 real estate markets surveyed.

Related: 24 US Cities With the Fastest Rising Home Prices

That marks the first increase in investment in single-family homes in more than two years, despite a slight dip in the average annual gross rental yield, a measure of a properties return on investment.

The activity of investors varied by region. Georgia accounted for seven of the top 10 counties in terms of institutional investor share.

“While average rental returns on properties purchased so far in 2016 are at a nine-year low, these returns are still attractive compared to other alternative investing opportunities,” Daren Blomquist, senior vice president at ATTOM Data Solutions said in a statement.

One in four single-family homes is now a rental property. This may be partly to blame for dearth of starter homes available for first-time homebuyers. The number of starter homes on the market fell more than 10 percent in the third quarter when compared to last year, according to Trulia.