The current supply of homes is completely inadequate to address the needs of an aging population that will grow significantly over the next two decades, according to a new report from the Harvard Joint Center for Housing Studies.

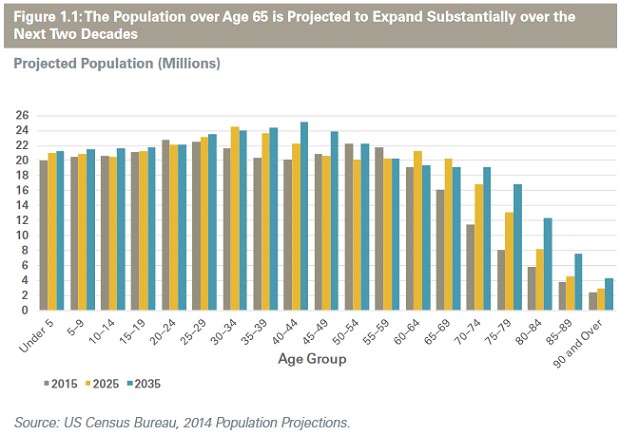

In the next 20 years, more than 20 percent of Americans will be over age 65, and someone in that age group will head more than a third of households. As they get older, those Americans will need homes that feature universal design elements like zero-step entrances, single-floor living and wider hallways and doors. Just 3.5 percent of today’s homes offer all three of those elements.

Related: 15 Great Jobs for Retirees

While many older Americans have the financial means to make the necessary adjustments, the report finds that 6.4 million low-income renters and 11 million homeowners will be spending more than 30 percent of their income on housing, leaving them with little money left over for home modifications or to pay for in-home services.

Additionally, the report notes, “today’s pre-retirees may face heightened financial challenges as they cross into later life because of the blow many were dealt by the Great Recession (including unemployment or early retirement, loss of savings, and declines in home equity) and impending shortfalls in Medicaid and Social Security.” “Compared to previous generations, higher shares of these older adults are carrying debt into retirement and smaller shares hold traditional pensions.”

The report makes several recommendations for addressing the situation, including building more accessible housing, helping older homeowners with housing costs, innovation in funding and delivery of home healthcare, and increased public awareness of the importance of incorporating housing needs into long-term care planning.