Two new reports by the Pew Charitable Trusts suggest that state governments across the country are shortchanging their employee pension funds and aren’t adding enough money in emergency funding accounts to prepare for the next economic crisis or recession.

While states have recouped much of the fiscal and economic ground they lost during the Great Recession, not all have them have rebounded, according to the non-partisan research organization. What’s more, there is considerable uncertainty over how President Trump’s agenda for federal tax reform, trade and health care will impact the states.

Related: States Face a $1 Trillion Pension Problem: Here Are the Worst 10

Mishandling hundreds of billions of dollars of pension funds and draining emergency spending accounts could pose serious problems for governors and state legislators when the next big economic crisis hits.

“It’s a missed opportunity,” Jonathan Moody, a states’ fiscal health expert with Pew said on Thursday in discussing the emergency accounts. “If you could be saving that money, and then you spend it instead – and in fact even draw on the funds further –the next time that the economy would turn south, you’re stuck with less money as a whole.”

Earlier this month, a senior official at S&P Global Ratings, a premier government credit rating agency, warned that nearly a dozen states with festering budget problems and woefully underfunded employee pension programs are struggling through “chronic budget stress” that could push them to the brink.

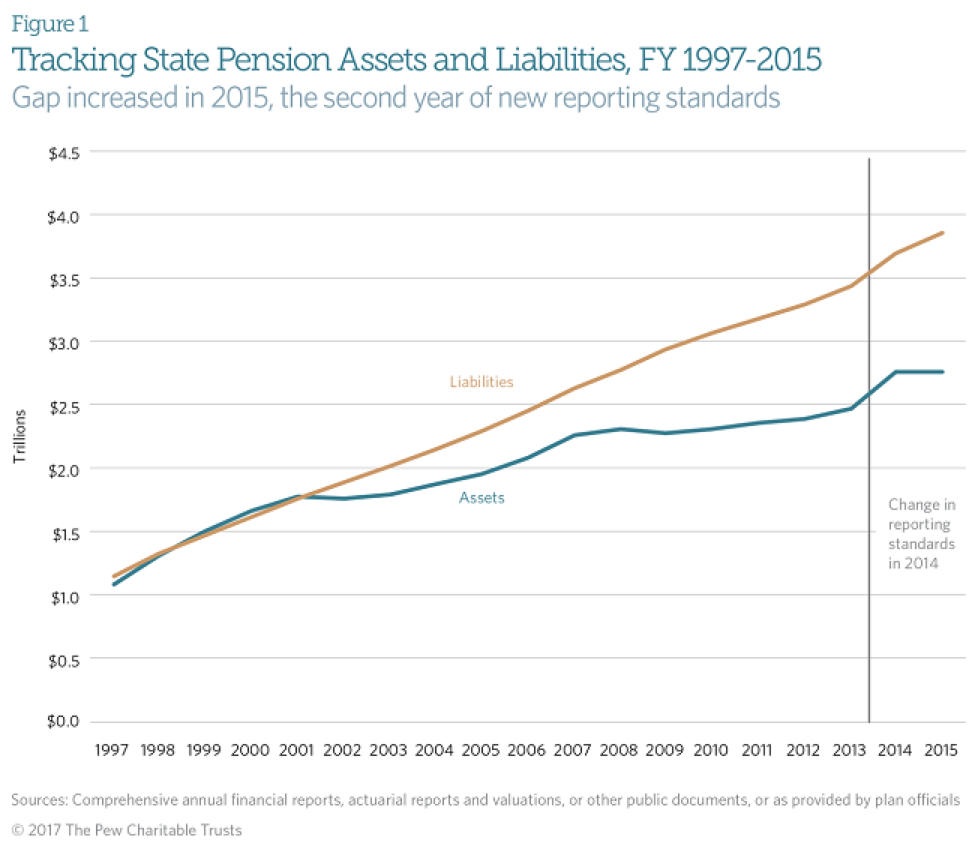

Shortfalls in the funding of pension programs in states like Pennsylvania, Illinois and New Jersey have been at near crisis levels for years, with no sign of improvement. The latest report by Pew on this problem issued Thursday shows a growing, $1.1 trillion gap between total assets reported by state pension systems and the benefits promised to workers as of fiscal 2015 – the most recent data available.

Related: Nearly a Dozen States Are Suffering From ‘Chronic Budget Stress’

That marks a $157 billion or 17 percent widening of the funding gap compared to fiscal 2014, according to the new report. The problem stemmed largely from disappointing returns on government investments, with median overall returns of just 3.6 percent.

When combined with the shortfalls in local government pension systems, the total state and local pension debt likely exceeded $1.5 trillion in fiscal 2015 – an historically high level of debt as a percentage of the overall U.S. economy.

“Many states face significant challenges in meeting pension promises to workers,” said Greg Mennis, director of Pew’s public sector retirement project. “The continued volatility and low investment returns are a reminder that policymakers cannot count on investment returns to close the pension funding gap.”

While many states continue to fall behind in funding their costly pension program, dozens of them have also mismanaged their so called “rainy day” funds. Those are special accounts that provide emergency funding to smooth out irregular cash flows and keep the doors of government open in the event of a financial crisis or another recession.

While the public is largely oblivious to the operations of these special accounts, Standard & Poor’s and other government credit rating services pay close attention to the ebbs and flows of these funds, analysts say. “They’re very attentive, and so they are looking to make sure that states are using them in the way they are designed and intended,” Moody said.

Related: Illinois Is Not Alone: States Facing $1 Trillion Pension Shortfall

Most states are required by law to stash away revenues in emergency spending funds during good economic times in anticipation of the next big economic crisis to come along. In the run-up to the 2008 financial meltdown and subsequent recession, most states experienced strong revenue growth of seven percent annually. If ever there was a good time to save up for a future crisis, that was it.

Yet a second report by Pew Charitable Trusts issued last week showed that between fiscal 2003 and 2007, 22 states that were relatively flush with tax revenues decided to make withdrawals at least once from their emergency reserve funds rather than sock away more revenue for the next big emergency.

Those states included: Arizona, California, Idaho, Indiana, Iowa, Kentucky, Louisiana, Maine, Maryland, Massachusetts and Michigan. Also, Mississippi, Nebraska, New Hampshire, New Jersey, New Mexico, Ohio, Rhode Island, Texas, Virginia, Washington State and West Virginia.

In contrast, eight other states that suffered through one of their worst recession-driven downturns in tax revenue between 2008 and 2010 declined to use any of their budgetary emergency funds. Instead, they ordered cuts in government services or raised taxes to make ends meet.

Related: States Keep Using Gimmicks to ‘Balance’ Their Budgets

Delaware, for instance, began fiscal 2010 faced with a $750 million budget shortfall because of declining personal and corporate income taxes. Instead of dipping into its Budget Reserve Account, officials relied on budget cuts and tax increases to make up the deficit, including a 2.5 percent reduction in state employees’ salaries. State officials apparently were concerned that credit rating agencies would frown on them dipping into their emergency account.

Seven other states did similar things, including Alaska, New York, Michigan, North Dakota, South Dakota, West Virginia and Wyoming. In the case of North Dakota, the state was rolling in energy severance tax collections and likely didn’t need to use the reserve account. However, in other states, like Delaware and New York, restrictive withdrawal rules likely played an important role.

Altogether, 30 states made dubious use of their emergency funds -- raising questions about how well those and other states are currently handling the funds and preparing for the next big fiscal crisis.

Related: Anti-Tax GOP Governors Find It Hard to Hold the Line

One of the problems is that most of the 47 states that utilize emergency funds are hampered by vaguely worded or highly restrictive policies for maintaining and utilizing emergency reserve accounts for their primary intent: keeping their budgets stable through good times and bad.

Rather than using their emergency funds in the most logical way – saving up for the next big crisis when times are good and drawing down on the accounts when times are bad – many states have followed counter-intuitive and counter-business cycle tactics.

“Rainy day funds are an increasingly useful tool,” said Moody, one of the authors of the Pew report. “Since the Great Recession, states’ tax revenues have grown increasingly volatile across the spectrum. So states are dealing with a lot more ebb and flow to the money that they bring in in any given year.”

Related: The Five Biggest Winners and Losers In Trump’s Fiscal 2018 Budget

Pew’s new report on pensions showing a $1.1 trillion gap between benefits promised and available funding was based on the examination of 230 public sector retirement plans throughout the 50 states for fiscal 2015. Some states are doing remarkably well in funding their pensions near or close to 100 percent while others appear hopelessly behind:

Five Highest Pension Funded Ratios (2015)

- South Dakota (104.1%)

- Wisconsin (98.3%)

- New York (98.1%)

- North Carolina (95.5%)

- Tennessee (95.4%)

Five Lowest Pension Funded Ratios (2015)

- New Jersey (37.5%)

- Kentucky (37.8%)

- Illinois (40.2%)

- Connecticut (49.4%)

- Pennsylvania (55.8%)

Pew’s preliminary analysis of 2016 data suggests that many states will continue to struggle in generating pension revenues through investments of their funds. Based on market volatility and low returns on investments averaging just one percent last year, pension liabilities were expected to increase by nearly $200 billion and reach a total of $1.3 trillion.