It’s a rare moment when a Republican tax policy pleases liberals but outrages conservatives.

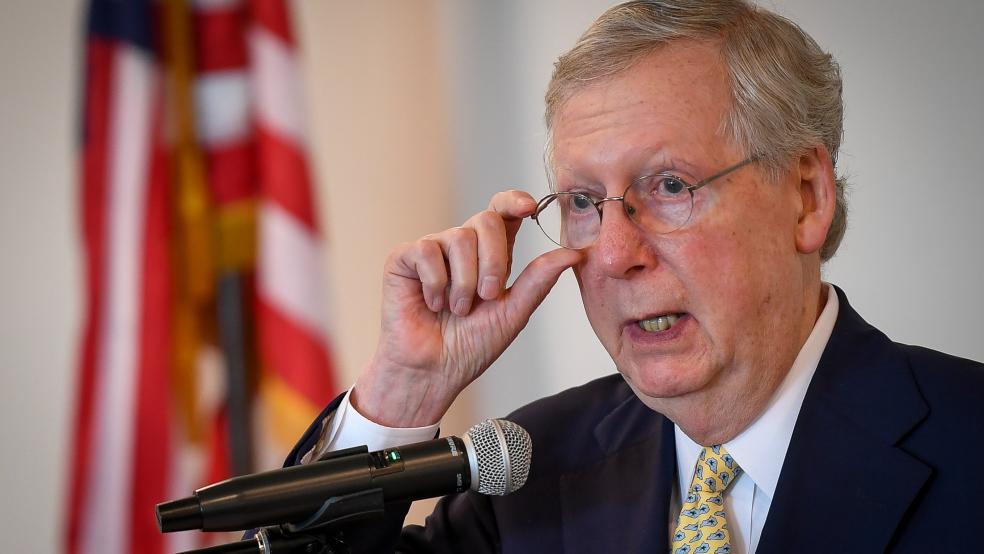

And yet that’s what happened on Thursday when Senate Majority Leader Mitch McConnell (R-KY) unveiled a major revision of the Republicans’ bill to repeal and replace the Affordable Care Act that will constitute a huge financial disappointment for some of the wealthiest people in the country if it prevails.

Related: Surprise! There Are Now Two Senate GOP Health Care Bills in Play

The original Senate Republican of the Obamacare overhaul plan and a House-passed version called for the repeal of about two dozen tax increases imposed by the Obamacare law, including two that were specifically aimed at people with high incomes. Those two measures imposed an additional 0.9 percent payroll tax on earnings and a 3.8 percent tax on net investment income for individuals with incomes exceeding $200,000 and couples with incomes above $250,000.

The two levies — one on the payroll tax that helps finance the Medicare health insurance program for the elderly and the other on investment income -- were among the biggest that the 2010 Obamacare statute imposed. Both of those taxes were designed to raise revenues by about $231 billion over a decade, according to the Congressional Joint Committee on Taxation.

But in a desperate bid to win over recalcitrant moderate Republicans with promises of $70 billion or more in additional funding to help reduce health insurance premiums, contain out-of-pocket costs and blunt some of the planned cuts in Medicaid, McConnell and other Senate GOP leaders chose to preserve those two sizable taxes in their revised health care bill awaiting action next week. McConnell needs at least 50 Republican votes to pass the legislation next week under budget reconciliation rules without Democratic support, but a handful of moderate and conservative Republicans are threatening to block the bill.

“Hopefully everything we’re doing now helps another member get to ‘yes,’” Senate Majority Whip John Cornyn (R-TX), told reporters on Thursday. “There’s really no other reason to tweak this thing.”

Related: McConnell Tries Business as Usual Amid a Trump Team Disaster

The responses came swiftly, but in surprising fashion.

The liberal-leaning Urban Institute & Brookings Institution Tax Policy Center praised the move to preserve the two taxes and declared the revised McConnell measure a definite improvement and “less regressive” than the original proposal.

“The fate of a health bill is likely to be decided by changes in Medicaid and in individual insurance coverage—provisions that disproportionately affect low- and moderate-income households,” The Tax Policy Center said in an analysis. “But by retaining two taxes on upper-income households, the Senate leadership has made one portion of its plan much less regressive than it was.”

By contrast, Americans for Tax Reform, the pre-eminent anti-tax lobbying group in Washington, registered a strong objection and vowed to repeal the two taxes on the wealthy later in the year, as part of the GOP’s major tax reform initiative.

Related: Why a Bipartisan Health Care Compromise Is Simply a Delusion

“All Obamacare taxes should be repealed,” declared Grover Norquist, president of the ATR. “The Trump tax reform plan, the House health bill, and the original Senate health bill abolished the Obamacare 3.8% Net Investment Income tax. Given the most recent language leaves some of the taxes in place, it is important for Senate Leadership to make it clear that those taxes will be abolished in tax reform this year,” Norquist added.

Obamacare contains 20 new or higher taxes on American families and small businesses, including taxes on the health industry and even tanning studios. But far and away the surtax on high-end investment income and the hike in the Medicare payroll tax – which both took effect in January 2013 -- are the most important in terms of covering the cost of operating the current national subsidized health insurance program the Republicans want to repeal. The investment surtax was expected to raise $123 billion in revenue over the coming decade while the Medicare payroll tax would net $86 billion, according to the Congressional Budget Office.

The payroll tax on high earners and the Medicare tax on unearned income took a healthy bite out of high-income Americans, and the Republicans’ original plan to repeal those taxes along with other Obamacare taxes was great cause for celebration in the nation’s high-rent neighborhoods. High-income taxpayers would no longer face Medicare taxes on all of their income – unlike low and moderate-income earners. And, as the Tax Policy Center has pointed out, “the disparity between the top tax rates on income from earnings and income from wealth would widen further.”

Related: Five Ways Republicans Can Regain their Mojo on Health Care

Millionaires would reap 79 percent of the tax cut from repealing these two provisions in 2025, according to the Tax Policy Center estimates. A distributional table shows that people with incomes below $200,000 a year would get nothing from a repeal of the two tax measures, and those earning $500,000 to $1 million a year would receive an average tax break of $510. But those earning more than $1 million a year could claim an average tax break of $54,130.

Howard Gleckman, an economist with the Tax Policy Center, said that the two tax increases – especially the surtax on investment income – stung many wealthy Americans who likely were relieved when they first heard about the congressional Republicans determination to repeal all the Obamacare taxes.

“It was real money for people who were in the $200,000-plus category, particularly the net investment income tax,” he said in an interview Thursday. “It was 3.8 percent on capital gains and dividends. That’s not nothing.”

For now, at least, wealthy Americans are stuck with those higher taxes.