The National Association of Home Builders, the powerful housing industry lobbying group, came out strongly against the Republican tax plan over the weekend after being told that the legislation would not include a tax credit for home owners. “All the resources we were going to put into supporting are now going to go into opposing the plan," the group’s CEO told Politico.

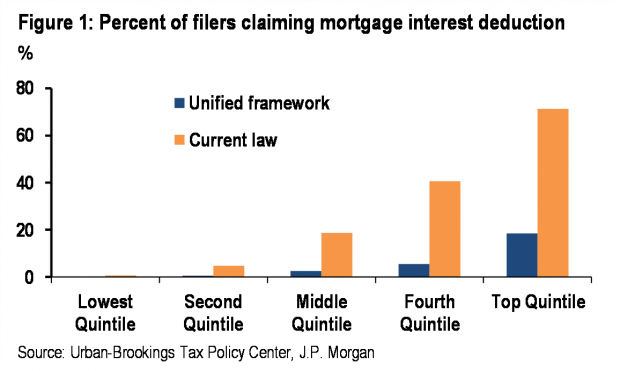

The home builders are unhappy because the tax plan includes elements that would undercut the benefit of the existing mortgage-interest deduction. Proposals to double the standard deduction, eliminate personal exemptions and at least partially repeal the break for state and local tax payments would likely increase the after-tax cost of home ownership — or at least reduce some financial incentives for buyers — which could dent demand. No wonder the home builders are vigorously opposed.

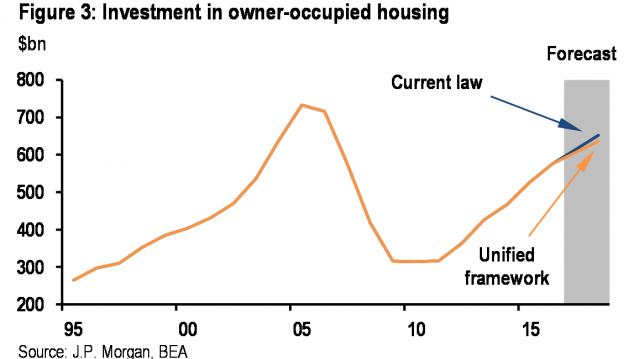

So how bad would the tax changes be for U.S. housing? In a new note to clients, J.P. Morgan economist Michael Feroli estimates that the changes being considered “would reduce investment in owner-occupied housing by about 2.5%.” That’s roughly $16 billion a year, which Feroli says is “a fairly modest amount” relative to the economy as a whole — less than 0.1 percent of GDP.

Feroli adds that if the tax code changes to reduce the incentive to buy a home, that money “may be channeled into other forms of investment, including tenant-occupied housing or business fixed investment, or into less saving and more spending on consumption goods and services.”

In other words, the hit would be to the housing industry, not to the economy overall.