"Don't fight the Fed," an old investing adage warns. Yet that's just what Republicans appear to be doing in their drive to stimulate the economy with a tax cut even as the Federal Reserve looks set to continue raising interest rates to prevent the economy from overheating. And the tax cuts are only one element of the extra jolt Congress could provide. Lawmakers may also increase spending in 2018, busting through caps on defense and discretionary outlays.

The amount of fiscal stimulus from the combined tax cuts and spending increases "is unlikely to be huge," notes Jim O'Sullivan, chief U.S. economist at High Frequency Economics. O’Sullivan and other economists estimate that economic growth could be boosted by about 0.5 percentage points next year. But any such stimulus at this point is likely to lead the Fed to speed up its interest rate hikes.

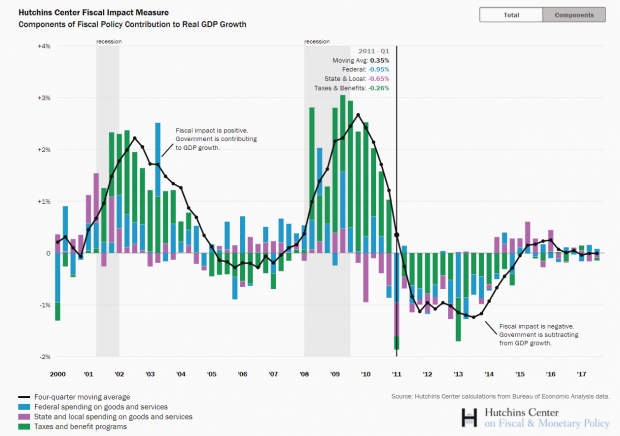

Such a scenario would resume a trend dating back to the aftermath of the financial crisis and Great Recession in which fiscal policy conflicted with monetary policy. As the chart below from the Hutchins Center on Fiscal and Monetary Policy at Brookings shows, federal tax and spending generally served as a modest drag on growth from late 2010 through the end of 2014, even as the Fed was looking to jumpstart an economy struggling to gather sustained momentum.

If the tax cut package passes, the Fed and lawmakers will again be turning their dials in opposite directions, only this time it will be fiscal policy adding stimulus and monetary policy pulling back. Goldman Sachs economists said Friday that they believe a tight jobs market and normalizing inflation outlook will lead the Fed to raise interest rates four times next year. “The U.S. economy heads into 2018 with strong growth momentum and an unemployment rate already below levels that Fed officials view as sustainable,” they wrote in a research note.

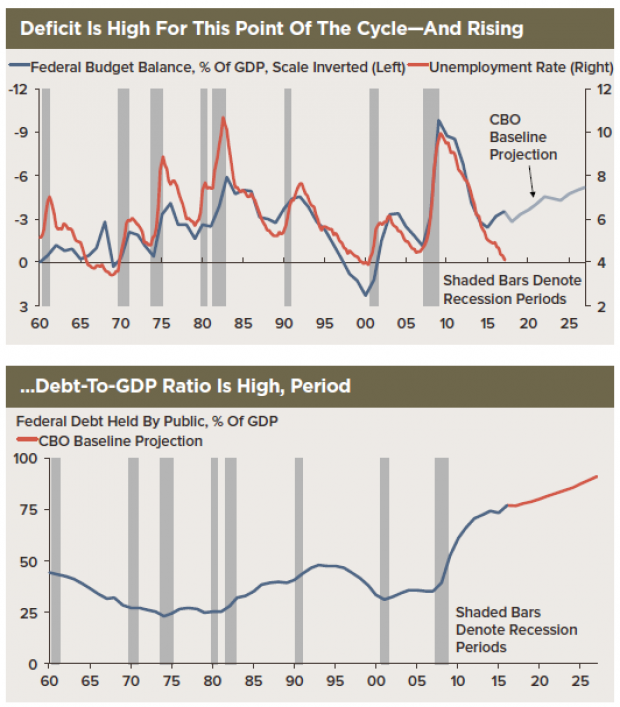

If the Republican tax plan will be fighting the Fed, it also carries additional risk because it raises the deficit, O'Sullivan warns: “Adding to the deficit now is subject to criticism not just because the economy has reached full employment and needs less, not more, demand-side stimulus. It can also be criticized on the basis that the deficit and federal debt are already too high. The higher they go, the less scope there will be for fiscal stimulus when it is really needed.”

In other words, the full cost of the GOP's quest to cut taxes at this stage of the economic cycle — as opposed to really reforming the tax code without adding to the deficit — may only become evident during the next economic downturn. While the Fed is working to replenish the ammunition it will need to counteract such a contraction, Congress may be wasting valuable bullets. Fighting the Fed now could weaken lawmakers’ ability to fight a recession later.