Both the House and Senate versions of the Republican tax bill lower the top corporate tax rate from 35 percent to 20 percent, and the final legislation is expected to stay close to that level. As the tax writers try to get the numbers to work in the final bill, The Washington Post reports Tuesday, they are considering a 21 percent top business tax. But according to Ed Yardeni of Yardeni Research, U.S. companies, on average, may be paying less than that already.

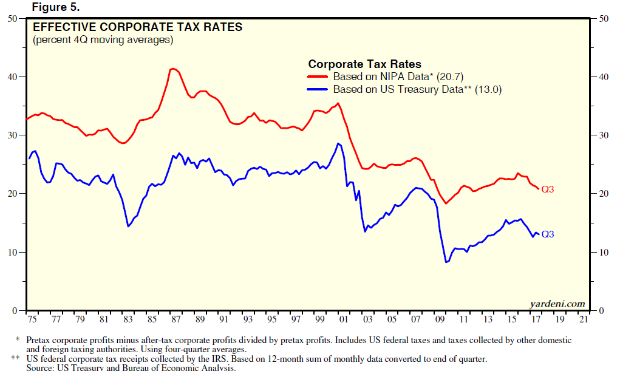

Noticing a discrepancy between tax data compiled by the Bureau of Economic Analysis and the tax revenues actually collected by the IRS, Yardeni adjusted the numbers and found that the effective tax rate paid by U.S. corporations is lower than previous estimates have indicated. How low? In a note to clients Tuesday, Yardeni writes that the effective corporate tax rate “was 20.7% during the four quarters through Q3 of this year.” Using a more complex calculation that removes distortions created by the profits earned by bonds held in the Federal Reserve system, Yardeni finds that the “tax rate has been below 20.0% since Q2-2008, and was just 13.0% over the four quarters through Q3!”

The accounting is complicated and the conclusions tentative, but if Yardeni is anywhere near right, it suggests that the GOP tax plan may not make much of a difference, at least for some U.S. companies. “The bottom line is that getting to the bottom line when it comes to matters of taxation is a very taxing exercise,” Yardeni says. “We’ll keep at it, but our conclusions so far are that corporations, on balance, may actually be paying less than the 20.0% statutory rate that the Republicans are aiming to enact.”