Scott Greenberg of the Tax Foundation has a reminder for anyone following the fiscal debate in Washington: “Tax Reform Isn’t Done.” That’s the title of a new paper from Greenberg and the topic of a public discussion at the conservative-leaning foundation today in Washington. Here are some highlights from the event’s Twitter feed:

Len Burman of the Tax Policy Center said that if he were to write a paper on the current state of tax reform it would be titled "Tax Reform Hasn't Started." And he added that, for starters, Congress should issue technical corrections, lift the cap on the child tax credit and expand the earned-income tax credit. And then lawmakers should get to work on a new tax bill in 2022.

Mattie Duppler of the National Taxpayers Union said that the policy community needs to step up and help states as now look to figure out how the new tax law will affect them and how they want to respond.

Alex Brill of the American Enterprise Institute reinforced the idea that tax reform will need more work, saying that a sound policy must be sustainable and predictable. And he argued that Congress should consider new ways to broaden the tax base to afford more sound, pro-growth reforms.

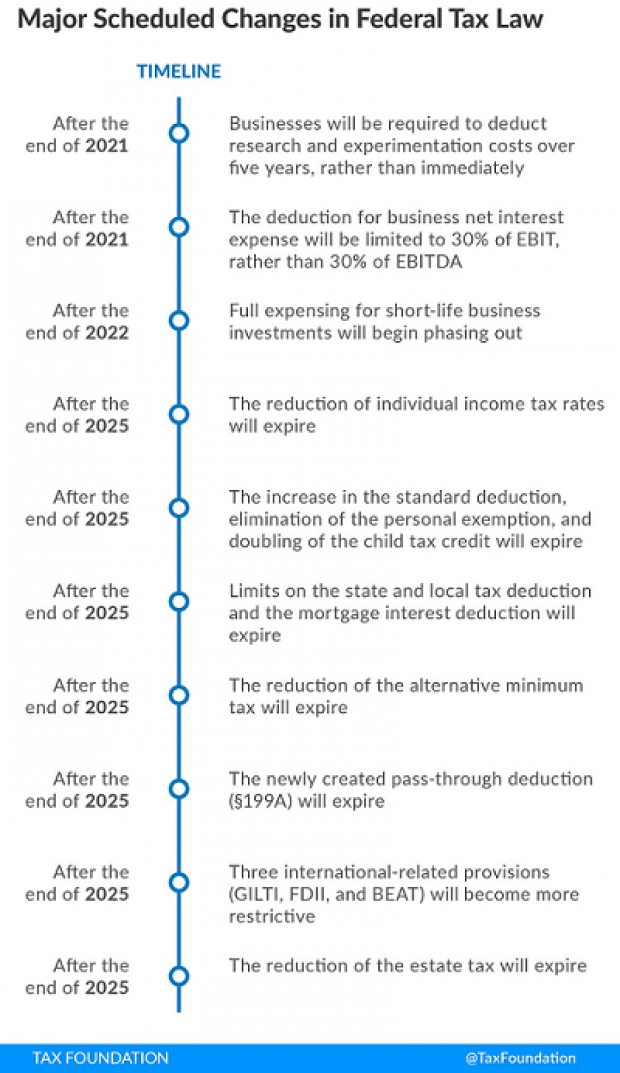

Here is Greenberg’s chart showing the many provisions in the tax bill that are set to expire over the next seven years, each providing an opportunity for Congress to make further changes: