Republicans face a dilemma in their quest to pass another massive tax cut ahead of November’s midterm elections.

Party leaders have pledged to make permanent individual tax cuts in the tax overhaul enacted late last year. Those cuts were set to expire in 2026 so that the legislation would comply with Senate budget rules. “We fully intend to make these things permanent, and that’s something we’ll be acting on later this year,” House Speaker Paul Ryan said this week.

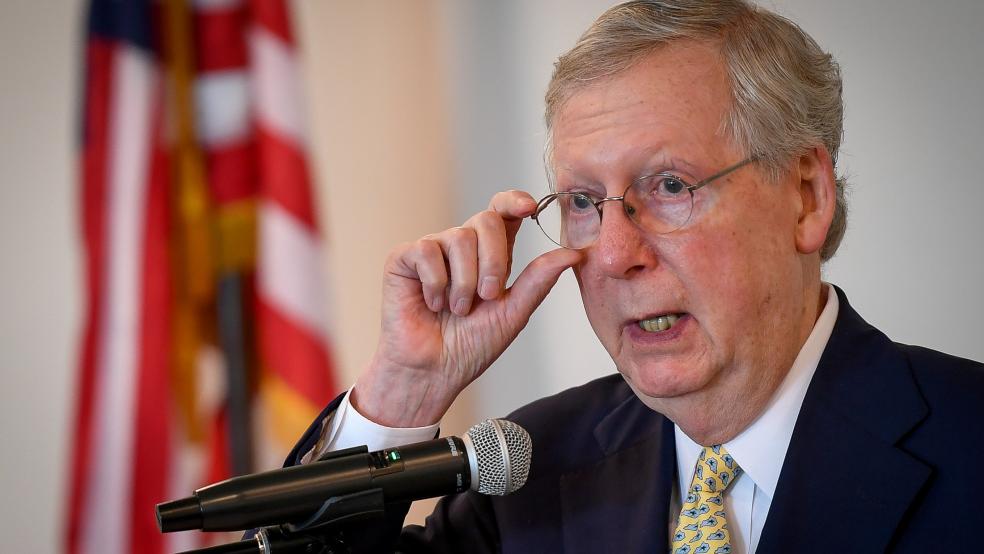

But another vote to cut taxes could be politically problematic, The Washington Post’s Erica Werner reports, and not just because last year’s tax law remains unpopular. Senate Majority Leader Mitch McConnell is under pressure to block another vote by Republicans who worry that it could help red-state Democrats, some of whom would likely back the new bill.

“Holding another vote would take away one of the bigger hits we have against Democrats for this fall” — that they voted against a tax cut — "and gives them a chance to take credit for work and progress made by President Trump and Republicans,” an anonymous Senate Republican campaign official told the Post.

While Republicans may be debating the political costs of holding another tax vote, many of them seem less worried about the actual fiscal cost of making the tax cuts permanent. The Congressional Budget Office has said that extending the individual tax cuts, along with some other expiring provisions of last year’s law, would cost about $650 billion from 2019 through 2028. But at least three Senate Republicans — Bob Corker of Tennessee, David Perdue of Georgia and Jeff Flake of Arizona — have expressed concerns over the deficit-increasing effects of making the tax cuts permanent, according to The Hill.

“I’d say, ‘Hell no. Hell no — double hell no,’” Corker said.