Former President Bill Clinton said this week that the Republican tax bill is a “bullet aimed at New York and California,” referring to the new $10,000 cap on state and local tax deductions that will hit residents of high-tax areas on the coasts particularly hard.

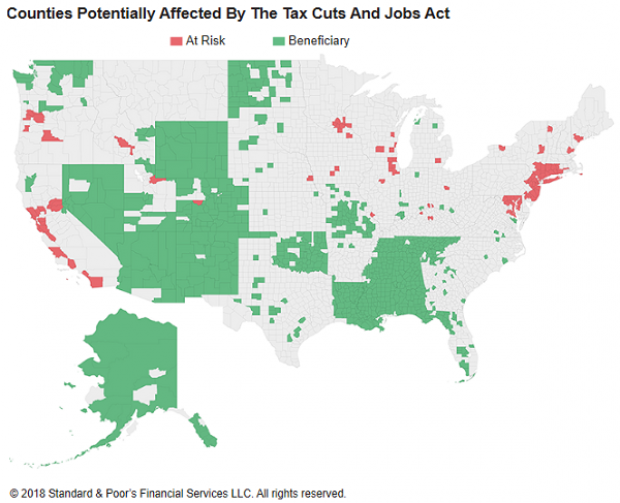

S&P Global Ratings released a study this week that analyzes the impact of the new tax rules at the county level and highlights the areas most at risk, and many of them are indeed in California and New York, along with other blue states including New Jersey, Maryland, Connecticut and Massachusetts.

S&P analysts defined three main threats facing high-tax localities in the coming years:

- a potential drop in demand for housing due to increased net costs for homeowners

- a reduction in support for high local taxes, resulting in possible financial problems for local governments

- a shift toward higher user fees and sales taxes to maintain existing services.

At the same time, some low-tax localities may benefit from the new rules as demand for housing increases.

The analysis shows 117 counties at risk of potential financial problems for residents and local governments (shown in red in the map below). On the other side of the coin, 700 mostly rural counties could benefit from an influx of new residents fleeing the financial problems of their high-tax hometowns, though S&P notes that the positive impact would likely be relatively modest.