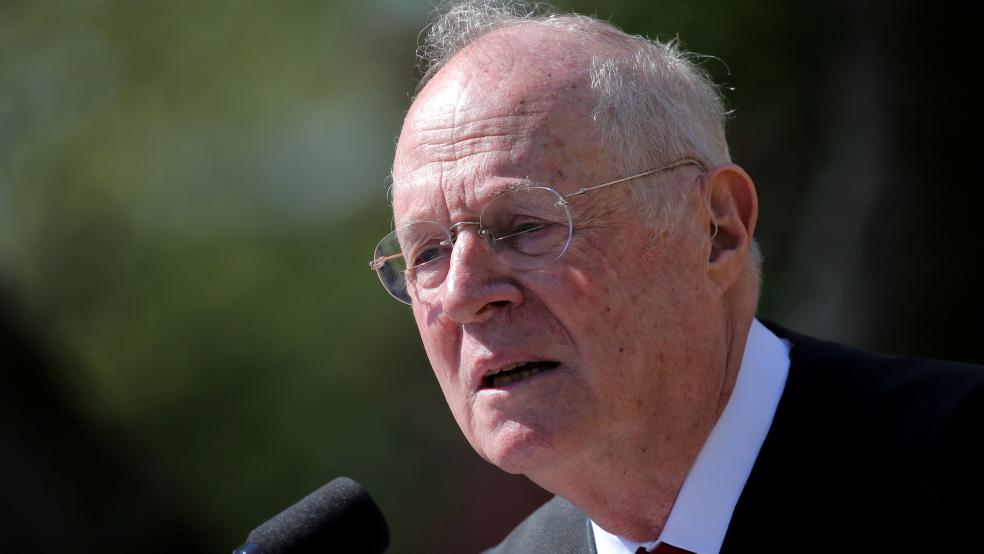

Supreme Court Justice Anthony Kennedy’s decision to retire is roiling Washington, with its potential implications for a wide range of issues, from abortion to voting rights. But Kennedy’s exit could also have an effect on tax law, at least in the near term, as the Senate gears up for what could be a brutal fight that pushes both a technical corrections bill and a second round of tax cuts to the sidelines.

Politico’s Morning Tax notes that it could delay fixes to glitches in the Republican tax law passed late last year by ramping up partisan battles over the vacated spot on the court: “Republicans will need help from Senate Democrats to move any legislation addressing snafus in their recent tax overhaul, which will probably be a lot less likely if lawmakers are at each other's throats over filling Supreme Court Justice Anthony Kennedy's seat. ‘This throws the Senate into a partisan tizzy,’ said one tax lobbyist. That could sink efforts to address technical problems with the Tax Cuts and Jobs Act, along with hopes of attaching unrelated tax provisions to a must-pass airline bill.”

And the Tax Policy Center’s Daily Deduction says that the coming confirmation hearing for President Trump’s nominee to replace Kennedy “almost surely kills what was already a long-shot: a second tax bill this year.”