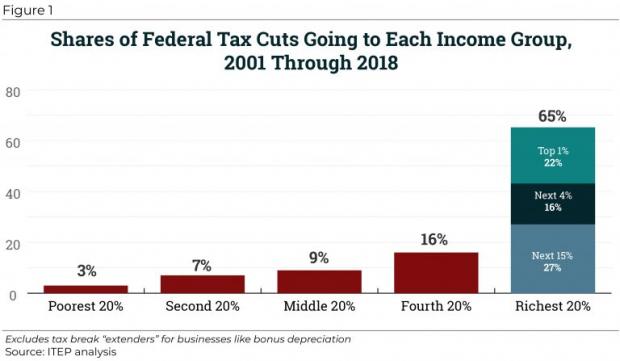

Tax cuts enacted since the turn of the 21st century have added nearly $6 trillion to the deficit while disproportionately benefiting wealthy households, according to a new study from the Institute on Taxation and Economic Policy.

Since President George W. Bush took office in 2001, “significant federal tax changes have reduced revenue by $5.1 trillion, with nearly two-thirds of that flowing to the richest fifth of Americans,” write ITEP’s Steve Wamhoff and Matthew Gardner. “The cumulative impact on the deficit during this period is $5.9 trillion, including interest payments.”

The tax cuts mean that the top-earning 1 percent of households, which take in more than $607,000 annually, will pay $111 billion less in federal taxes this year than they would have under the tax code from 18 years ago. By 2025, the combined effects of tax cuts passed this century will total more than $10 trillion, with about $2 trillion of that going to the top 1 percent of households.

Federal fiscal policy has worsened the long-term trend toward greater economic inequality in the U.S., says David Leonhardt of The New York Times. “Income inequality has soared in recent decades, with the wealthy pulling away from everyone else and the upper-middle-class doing better than the working class or poor. Yet our federal government has responded by aggravating these trends. It has handed huge tax cuts to the small segment of Americans who need those tax cuts the least,” Leonhardt wrote Wednesday.

Michael Linden of the liberal Hub Project wrote a series of tweets providing some context for the numbers in the reports, including, “Since 2001, we have spent MORE money on federal tax cuts for the top 1% than we have on highway construction and maintenance. Which of those two things do you think is better for the economy?”

Kevin Drum of Mother Jones made two salient observations about the ITEP analysis. The first addresses the degree to which fiscal policy over the last 18 years has favored the wealthy: “The average rich household today pays nearly $100,000 less in taxes than they would under the Clinton-era tax code, while the working and middle classes pay about $1,000 less.”

Drum’s second point addresses the revenue losses resulting from the repeated tax cuts: “ITEP figures that total taxes paid in 2018 are about $600 billion less than they would be if we had just left the tax code alone. That’s nearly the entire federal deficit projected for this year. … Republican tax cuts since 2000 are responsible for nearly the entire federal deficit. Repeal them all and the budget would be almost balanced.”