Wages don’t seem to be rising in the wake of the corporate tax cuts that went into effect this year, and many critics of the GOP tax overhaul say there’s little reason to think they will. But the Trump administration maintains that wage growth is just around that corner and may already here, despite the statistics, with the president’s top economic adviser Larry Kudlow claiming Tuesday that real disposable income is booming.

The conservative Tax Foundation offered a defense of the tax overhaul Tuesday that includes a good summary of why so many conservative policy experts expect wages to rise as a result of the corporate tax cuts.

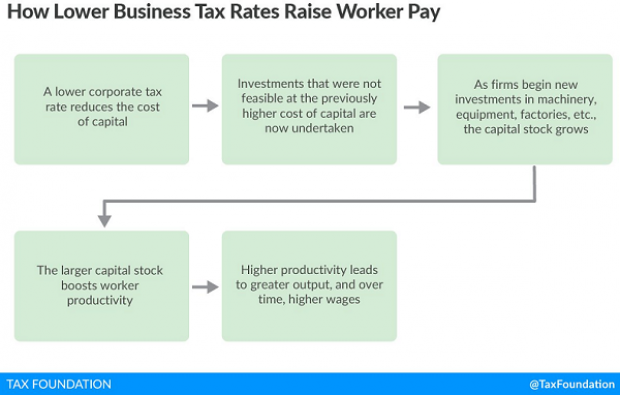

In the Tax Foundation’s relatively simple economic model, corporate taxes have numerous negative effects which are reduced as taxes fall. The Foundation’s Erica York says that companies will flee areas with high tax rates, reducing productivity and wages, and those that remain will pass off much of the tax burden to workers in the form of lower pay. As taxes are reduced, however, investment becomes more profitable and companies start spending on new property and equipment, deepening the capital stock in ways that boost productivity and wages.

York’s summary of the argument: “Capital formation, which results from investment, is the major force for raising incomes across the board. More capital for workers boosts productivity, and productivity is a large determinant of wages and other forms of compensation. This happens because, as businesses invest in additional capital, the demand for labor to work with the capital rises, and wages rise too. It is because of these economic effects that, of all the permanent elements considered during the tax reform debates, reducing the corporate tax rate was the most pro-growth.”

The Tax Foundation is hardly alone in making this argument, and other pro-tax cut groups and economists, including the head of President Trump’s Council of Economic Advisers, Kevin Hassett, have offered similar analyses. Here’s the Tax Foundation’s simplified chart showing the connection between lower corporate taxes and rising wages.

Responding to the Tax Foundation report, Matthew Yglesias of Vox said that the analysis may provide a rationale for tax breaks on new investments, but the tax cuts are providing a windfall for already existing ones. More fundamentally, Michael Linden of the Roosevelt Institute the Hub Project said that the simple, theoretical model that guides supporters of the tax cuts fails to recognize the real conditions in the economy, notably:

* Capital has been cheap for years, and there’s little evidence that companies were capital constrained before the tax cuts.

* The link between worker productivity and wages is weak.

* Shareholders may simply keep the tax cut windfall for themselves, especially in an economy dominated by large companies facing limited competition.

Either way, it will take years before we know which side of the debate is correct. The Tax Foundation’s Nicole Kaeding tweeted that York’s analysis “explains at length why lowering the corporate income tax results in higher wages and increased productivity in the long run. These changes, however, take a while to materialize.”