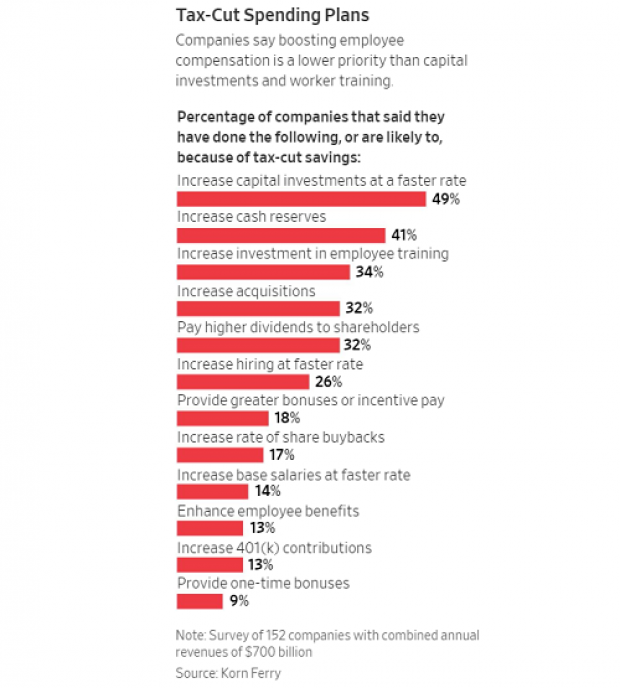

Three new surveys confirm what some critics of the GOP tax cuts have been saying all along: companies aren’t sharing much of their tax-cut windfall with workers in the form of higher wages. While some firms do report plans to increase wages, most intend to use their tax-cut savings for investment and acquisitions, hiring and training, share buybacks and one-time bonuses.

Here’s a rundown on the new data from Tuesday’s Wall Street Journal:

“A new survey of 152 companies by executive-recruitment firm Korn Ferry International revealed 14% were putting part of their tax-cut savings into base salary increases. A poll of 1,500 companies by consulting firm Mercer LLC showed 4% are redirecting tax savings to budgets for bigger paychecks in the coming year. And in a survey of more than 1,000 companies published by human-resources consulting firm Aon PLC, 99% said the tax cuts weren’t prompting them to increase minimum wages.”

Some economists have found that, as a general rule, tax cuts are not used to boost wages, and other studies have found that companies now prefer to provide bonuses and other one-time benefits to workers, to avoid increasing their fixed employment costs.

So what are firms doing with their tax cut money? Here’s a chart from the Journal piece based on Korn Ferry’s survey.