The GOP’s 2017 tax overhaul slashed the top corporate tax rate from 35% to 21% and, not surprisingly, business income tax revenues have dropped sharply.

A combination of lower tax rates and more generous tax breaks for things like equipment purchases produced a 31 percent drop in corporate tax revenues in fiscal year 2018 compared to the year before, according to data released in March by the Treasury Department. Corporate tax revenues in fiscal year 2017 were $297 billion, but just $205 billion in fiscal year 2018, even as the economy was growing at a faster pace.

“This is the first time corporate taxes have taken such a hit when the economy is not in recession,” CNN’s Lydia DePillis wrote Monday.

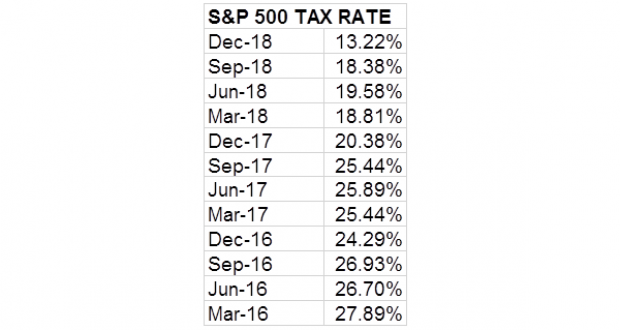

A big drop in effective rates: Howard Silverblatt of S&P Dow Jones Indices said in a note Sunday that the effective tax rate for S&P 500 companies fell to 13.22% in the fourth quarter of 2018 — a “significant drop” from the 24.29% rate recorded in fourth quarter of 2016 (see Silverblatt’s chart below).

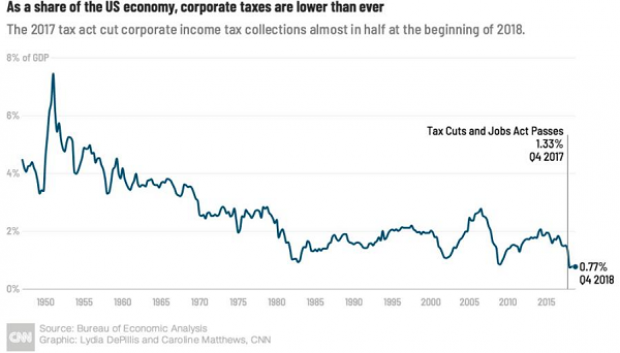

Less than 1% of GDP: Corporate tax revenues averaged more than 4% as a share of gross domestic product in the 1950s, before sliding down closer to 2% in the following decades. In the fourth quarter of 2018, corporate tax revenues fell to just 0.77% of GDP, according to CNN’s DePillis. The Congressional Budget Office expects such revenues to rise gradually in the coming years, though nowhere near enough to pay for the 2017 tax cuts. A report released last week by the Institute on Taxation and Economic Policy showed that 60 Fortune 500 firms paid no federal income taxes last year, twice as many as the year before.

Too steep a cut? David Leonhardt of The New York Times argued Monday that while a reduction of the corporate tax rate is defensible on grounds that it moves the United States closer to international standards, the cut was too big and the overhaul included too many tax breaks. “A better bill would have paired a more gentle decline in the rate with a tougher approach to tax breaks, essentially trying to level the playing field among companies,” Leonhardt argued.

Leonhardt also noted that most U.S. companies never really paid the top rate: “Even before the law change, American companies weren’t actually paying very much in taxes.” The CNN chart above underlines his point.

Record business investment: S&P’s Silverblatt said that capital expenditures — the business investments that the tax cuts were designed in part to increase — did indeed set a record of $177 billion in the fourth quarter of 2018. But the record was only slightly higher than previous cyclical peaks — $173 billion in 2016 and $175 billion in 2014, for example — and businesses are projecting less investment in the coming quarters. White House economists say that increased business investment will produce higher growth for years to come, but independent experts have their doubts, with most estimates showing GDP growth falling to about 2.4% this year and in the 2% range in 2020 and beyond.