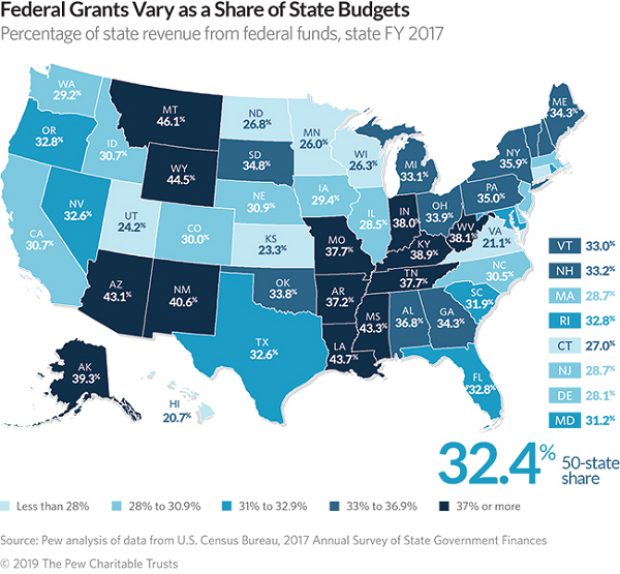

The federal government provided 32.4% of all state revenues in the 2017 fiscal year, according to a new analysis by the Pew Charitable Trusts. That’s roughly in line with the year before, when federal revenues came to 32.6% of state revenues, but well above the 20-year average recorded from 1978 to 1997, when the federal government provided about 25% of state revenues.

Federal dollars play an increasingly important role in state budgets, driven in large part by rising health care spending, as the report makes clear:

“Historically, the federal share of 50-state revenue has ranged from about one-quarter to one-third. The highest shares occurred just after the Great Recession, when a temporary influx of federal economic stimulus dollars and falling state tax revenue caused the federal share of states’ revenue to reach 35.5 percent in fiscal 2010 and 34.7 percent in fiscal 2011. The third-highest share was in fiscal 2016, largely because of growth in Medicaid grants to states. Medicaid accounts for about two-thirds of federal grants to states.”

The largest single source of revenues for the 50 states in 2017 was taxes, including income, sales and property taxes, which together provided 48% of overall revenues. Service charges, including tolls, tuition fees and hospital charges, contributed about 12%. Miscellaneous charges, such as fines and fees from property sales, made up the remaining 8%.

Seven states received more money from the federal government than from any other source: Alaska, Arizona, Louisiana, Mississippi, Montana, New Mexico and Wyoming.