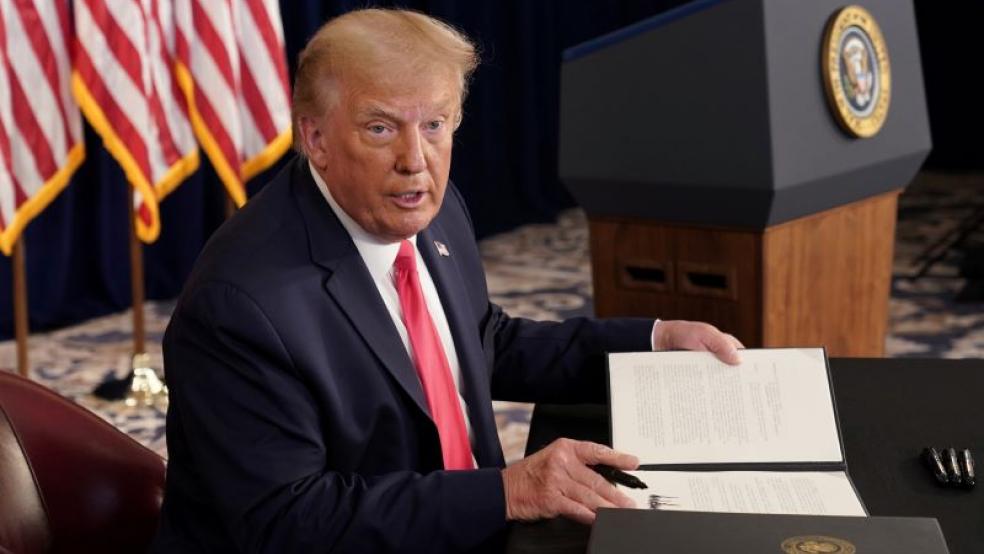

President Trump’s effort to suspend employee Social Security taxes starting September 1 is hung up over a dispute over who should be responsible for making the tax payments once the suspension is over at the end of the year.

According to Bloomberg Thursday, the White House wants employers to be on the hook for paying the suspended payroll taxes, not employees. The IRS, however, says that both employers and employees would be responsible and subject to collections efforts.

The dispute between the White House and the Treasury Department over the issue has delayed the publication of guidelines that businesses say they need to decide whether to participate in the program. Many companies have expressed concerns about delaying tax bills until next year, and last week the U.S. Chamber of Commerce said the plan is “unworkable.”

Eliminate the suspended taxes? Top White House economic adviser Larry Kudlow said last week that the Trump administration is considering forgiving the payroll tax of 6.2% that employees pay to help fund Social Security. The taxes “essentially can be forgiven if you stretch it out five years, eight years,” Kudlow said.

President Trump has also said that he would urge Congress to forgive the taxes if he wins a second term, though few believe that lawmakers would embrace the idea.

Few companies expected to participate. The tax suspension was already a bit rushed, and the delay in providing guidance means that few companies are expected to start suspending payroll taxes when the program begins next month. “It’s unlikely that many employers will be able to make the programming changes by September 1,” Pete Isberg of the payroll processing firm ADP told FOX Business. “We’ve advised Congress and Treasury that anything like this normally requires at least six months for an orderly programming transition.”

Companies wary of the proposed program may be relieved that the delay is making the whole thing easier to avoid. “The fact that there hasn’t been guidance is, in some ways, a positive for a lot of clients who really were not looking forward to having to deal with it,” tax attorney Adam B. Cohen of Eversheds Sutherland LLP told Bloomberg.