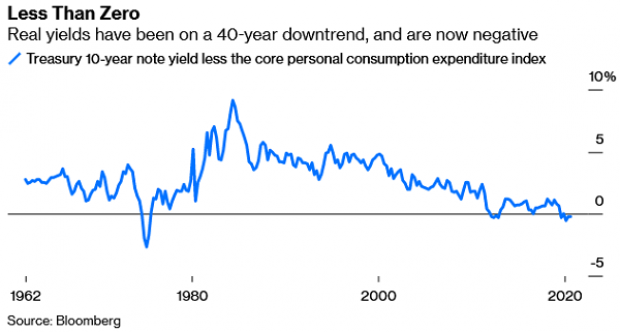

Real interest rates are negative, which means the federal government is essentially getting paid to borrow money right now, once inflation is taken into account. Writing at Bloomberg Monday, Wall Street analyst Paul Podolsky argues that short of widespread social chaos or a balance of payments crisis, the only thing that could push real interest rates back above zero is massive public investment in infrastructure. Doing so would kill two birds with one stone by making much-needed investments in public goods while restoring interest rates to a more normal range.

While both Republicans and Democrats have talked enthusiastically about infrastructure investment, the problem – aside from their notable inability to get anything done – is that their proposals in the range of $1 trillion to $2 trillion are too small. “To boost growth above its economic potential of about 1.5% a year and match estimates of what is needed to be spent on infrastructure, an investment of around $4 trillion, or close to 20% of gross domestic product, is warranted,” Podolsky says.