The CBO also updated its budget outlook Wednesday, estimating that the federal budget deficit for fiscal year 2020 would come in at $3.3 trillion, down from its previous estimate of $3.7 trillion. The deficit for the 2021 fiscal year was projected to be $1.8 trillion.

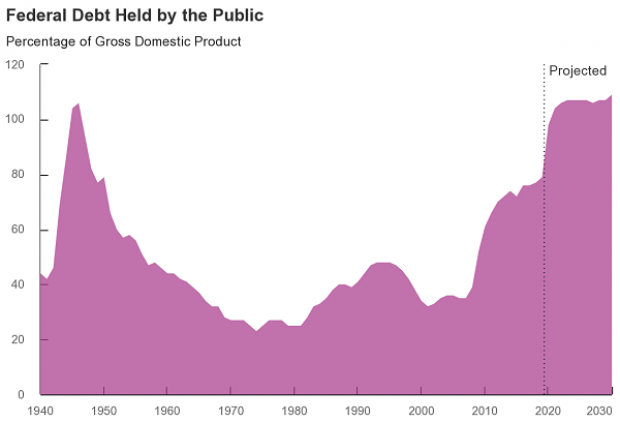

The new projections mean that the national debt is already close to the size of the total economy and will likely surpass it next year. The CBO said it expects federal debt held by the public to equal roughly 98% of the size of the economy by the end of 2020 and exceed 100% in 2021. By 2023, the debt will equal 107% of GDP – the highest level in U.S. history, exceeding the previous peak set in 1946 in the aftermath of World War II.

By comparison, the debt-to-GDP ratio stood at 79% at the beginning of 2019 and 35% in 2007.

The CBO said federal outlays will equal about 32% of GDP in 2020, a roughly 50% increase from the year before and the highest since 1945. Outlays are projected to fall to roughly 22% of GDP over the next five years. Revenues are expected to fall from 16.3% of GDP in 2019 to 15.5% in 2021, due to the economic effects from the pandemic, before rising to 18% of GDP by 2030.

Deficits expected to continue. “It will be hard to ratchet down this spending going forward, and we are going to be entering a long stretch of deficits well above historical averages,” G. William Hoagland of the Bipartisan Policy Center told The Washington Post. Hoagland also said he doubted the issue would take center stage politically any time soon: “[A]s a matter of national politics, the deficit was not a matter of concern before the pandemic and it won’t be after.”

Former CBO chief economist Wendy Edelberg said she doubted the latest increase in the size of the debt was significant in and of itself. “There’s no economic difference between a ratio of 99% and a ratio of 101%,” she told The Wall Street Journal. She also said he coronavirus-related deficit spending was money well spent. “It was a massive rise in borrowing and quite shocking, but incredibly effective. On the flip side, this is exactly why we, as a country, want to have room to increase borrowing during times of emergency.”

Maya MacGuineas of the Committee for a Responsible Federal Budget said the latest numbers serve as a reminder that the debt remains an important issue. "What should be absolutely clear from today’s report is that after the virus is contained and the economy has recovered, lawmakers cannot afford to continue ignoring the trajectory of our debt any longer," she said.