The $10,000 cap on state and local tax deductions imposed as part of the 2017 Republican tax law is not causing high-income taxpayers to flee high-tax blue states, according to Carl Davis, research director at the progressive Institute on Taxation and Economic Policy.

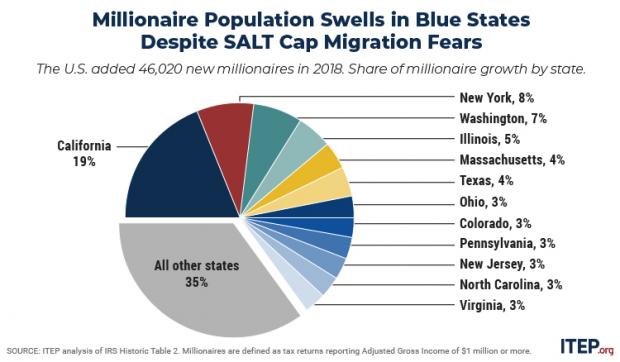

In a blog post last week, Davis said that new IRS data show that states including California and New York added a significant number of millionaires to their tax rolls from 2017 to 2018. “California and New York saw more growth in millionaire tax returns than any other state in 2018,” Davis wrote. “Taken as a group, California, New York, New Jersey, Massachusetts, and Illinois saw 40 percent of the nation’s growth in millionaire tax returns occur within their borders, despite the fact that these states are home to just 27 percent of the nation’s population.”

But Politico’s Weekly Tax notes that “it’s also undeniable that traffic is more going away from high-tax states and toward low-tax ones” and analysts on the other side of the political divide argue that taxes play a sizable part of such decisions.