Joe Biden’s tax plan would have high earners paying significantly more, with the top 1% of households shouldering 80% of the increase while those earning less than $400 would see no change on average, according to a new analysis by the Penn Wharton Budget Model.

The basics of Biden’s proposals: Biden’s tax plan calls for repealing elements of the 2017 Republican tax law, including restoring the top income tax rate to 39.6%, where it was before the new law cut it to 37%. Biden would also raise the corporate tax rate from 21% to 28%, subject earnings over $400,000 to the Social Security payroll tax and treat capital gains and dividends the same as earned income, among other proposals.

Who gets hit: Under Biden’s plan, the effective tax rate on the top 0.1% of earners — those now making roughly $3.3 million a year or more — would rise by 12.4 percentage points to 43%, the Penn Wharton model says. Households earning more than $400,000 would see their after-tax incomes decrease by 17.7% on average, compared to a 0.9% decrease for those earning $400,000 or less.

The drop for the latter group is not due to direct tax increases but is the result of lower investment returns and wages projected under the Pen Wharton model as a consequence of Biden’s corporate tax hike. “Relative to current law, the Biden plan leaves the income and payroll taxes of almost all households below the 95th percentile of income unchanged,” the analysis says.

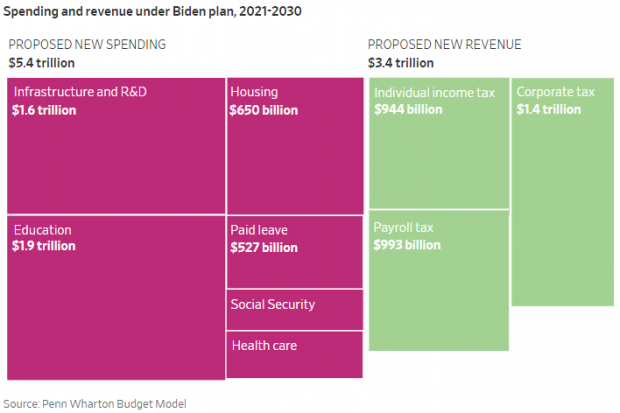

The big picture for the federal budget: In all, Biden’s policy plans would raise $3.375 trillion in additional revenue over 10 years, the Penn Wharton model finds. Biden’s corporate tax increase is the biggest revenue raiser, projected to generate more than $1.4 trillion over 10 years, followed by his payroll tax plan ($992.8 billion) and individual income tax plan ($944 billion).

Biden’s platform would also increase spending by $5.35 trillion, the report says. The largest areas of new spending would be education ($1.9 trillion over 10 years) and infrastructure ($1.6 trillion). Factoring in the macroeconomic and health effects of Biden’s platform, the report projects that by 2050, federal debt would decrease by 6.1% and gross domestic product would rise by 0.8% relative to current law.

Big spending increases: As The Wall Street Journal’s Jacob M. Schlesinger and Eliza Collins note, Biden’s proposed budget is more than double what Hillary Clinton proposed as the 2016 Democratic nominee. “This is the largest proposed spending increase by a presidential nominee since George McGovern” in 1972, Penn Wharton Budget Model’s Kent Smetters told the Journal.

Schlesinger and Collins provide some additional context: “If fully enacted, the Biden plan would mean federal spending would equal nearly a quarter of all economic activity in the U.S. That is up from 21% in 2019, but well below the jump to 30% this year amid the pandemic,” they write. “It is also below the level of government spending in most of the world’s developed countries—and far short of the social democracies of Europe, where the public sector in many countries equals roughly half of GDP.”

Biden aides also tell the Journal that he is committed to avoiding a continued expansion of the national debt, pointing to that as an area of contrast with President Trump. At the same time, Biden’s camp “has left itself wiggle room, by saying that their commitment to paying for new spending only covers plans they consider permanent, and needn’t apply to short-term stimulus to counter the recession,” Schlesinger and Collins report. “Aides also say that some big-spending proposals—such as fixing crumbling infrastructure—are intended to last only a few years, and wouldn’t expand the budget over the long run.”

The bottom line: The Penn Wharton Budget Model’s numbers refute a key Trump attack line against Biden while pointing up the differences between the two candidates on taxes. “The Trump campaign has run ads saying Biden’s increases would crush middle-class families, but the data show there would be little effect for most who earn less than $400,000,” Laura Davison of Bloomberg News writes. “Trump has said he wants to cut taxes again, but hasn’t released a plan on how he would do that.”

You can dig into the details of Penn Wharton Budget Model analysis here.