U.S. payrolls shrank by 140,000 in December, bringing the jobs expansion that started in April to a halt, the Department of Labor announced Friday.

The job losses were concentrated in the leisure and hospitality sector, which lost nearly half a million jobs during the month as restaurants and bars closed in response to the dramatic resurgence of Covid-19 throughout the country.

The unemployment rate held steady at 6.7%, following seven straight months of declines.

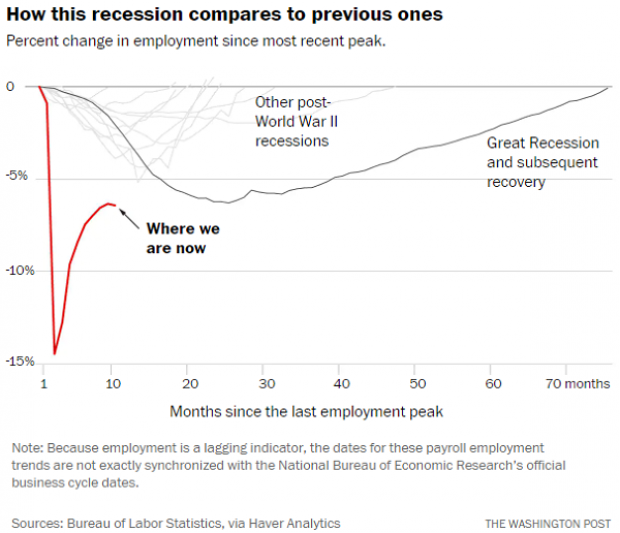

For the full year, job losses totaled 9.37 million – the most dating back to at least 1939.

Good news amid the bad: Beyond leisure and hospitality, the labor market displayed solid gains. “Outside of consumer-facing sectors the remainder of the economy continues to show resilience,” Michael Gapen, chief U.S. economist at Barclays, told Bloomberg. “It does show that if we can get control of the pandemic, then we can restore economic activity and labor market conditions over the course of this year. It’s a pandemic-driven number, a pandemic-driven composition.”

The reversal in the labor market should be short-lived, said Joseph Brusuelas, chief economist at the consulting firm RSM. “While the trend in hiring has slowed in recent months — December’s decline was the first since April — we expect that this is more of a temporary lull in hiring than the breakout of a new trend that results in soaring unemployment,” Brusuelas wrote in a note Friday. “Rather, we expect that mass vaccine distribution this year will create the conditions for faster growth and employment.”

Michael Pearce of Capital Economics said the report indicates underlying strength. “With employment in most other sectors rising strongly, the economy appears to be carrying more momentum into 2021 than we had thought,” Pearce said in a note to clients.

But pain persists for millions: While the unemployment rate is lower than most economists expected at this point in the recovery, millions of workers who have left the labor market are not included in the statistic. Taking those workers into account, along with others who may be misclassified by the Bureau of Labor Statistics, the unemployment is closer to 8.6%, according to calculations by economist Jason Furman, who led the Council of Economic Advisers in the Obama administration.

State and local governments need assistance: State and local governments also shed jobs in December.

“State & local government employment fell by a further 45,000 which, unlike previous months, was not due to a fall in education payrolls, and so probably reflects broader budget constraints starting to bite,” Capital Economics’ Pearce wrote.

The state and local sector will need more money from Congress, Catherine Rampell of The Washington Post said. “Already, state and local governments have shed about 1.4 million jobs since February on net; most of them are in education. More layoffs — of teachers, police officers, public hospital employees, etc. — are probably coming,” she wrote. “One of the lessons from the Great Recession was that public-sector job losses significantly slowed down the ability of the private sector to recover. Congress must prevent this foreseeable problem from happening again.”

Expect the debate over state and local aid to be front and center in the coming weeks, said RSM’s Brusuelas: “The fiscal challenges faced by the states and municipalities are significant, illustrated by the loss of 45,000 jobs in December. In our estimation, we expect this to be one of the primary narratives in the debate on fiscal aid ahead of the benefits cliff approaching in March.”

Help is on the way: The $900 billion stimulus and relief package signed into law in late December should provide a significant boost to the economy, softening the blow from the resurgent virus. “Without that stimulus package, over 10 million people would have lost unemployment insurance benefits at the end of December,” Heidi Shierholz of the Economic Policy Institute told Marketplace. “That would have been a huge drag on the economy that we will not see.”

Capital Economics’ Pearce said that while the labor market could be in for a few more rough weeks, he expects the economy overall to keep growing. “With coronavirus infections still rising nationally, payrolls could fall further in January. But with most of the high-frequency indicators suggesting that the rest of the economy is still holding up and additional fiscal stimulus starting to feed through, we still expect first-quarter GDP growth to be positive.”