The tax changes proposed by House Democrats this week would lower taxes for most Americans, at least in the near term, while hitting top-earning households with sizable increases, according to estimates released Tuesday by the bipartisan congressional Joint Committee on Taxation (JCT).

The Democratic plan, which is being debated again this week by the House Ways and Means Committee, calls for restoring a top marginal individual income tax rate of 39.6%, up from the current 37%. It also includes a host of other changes to individual, capital gains and corporate taxes that, combined, would raise more than $2 trillion for the U.S. Treasury over the next 10 years, according to the JCT.

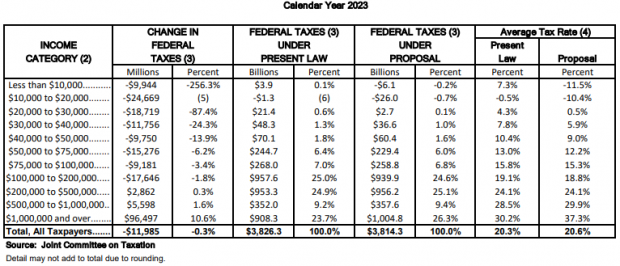

The congressional tax scorekeeper estimated that households making less than $200,000 a year would see lower tax bills through at least 2025, largely as the result of the expanded child tax credit, while those making at least $1 million a year would face a 10.6% increase in federal taxes in 2023 and a 12.1% increase by 2025. The average federal tax rate for those top-earners would climb from 30.2% now to 37.3% in 2023 and 38.1% by 2027.

The JCT estimates don’t include Democrats’ proposed increase in the estate tax, meaning that the tax hit on wealthy households would be even higher.

“We are taking a significant step toward leveling the playing field,” House Ways and Means Committee Chair Richard Neal (D-MA) said Tuesday. “No one likes raising taxes, but thanks to the strength of our economy, we can afford to do this.”

A problem for President Biden? The JCT estimates show that households making between $200,000 and $500,000 a year face an average tax increase of 0.3% in 2023. They also show that if lawmakers allow temporary changes to the tax code to expire as scheduled, including the expansion of the child credit, households making between $30,000 a year and $200,000 a year would see their taxes go up slightly, on average, by 2027. Households making $30,000 to $40,000 a year would see their average tax bill rise by 0.1% while those earning between $100,000 and $200,000 would face a 1.5% average increase.

The House budget plan would extend the credit for four years and many Democrats want to make the new child tax credit permanent, but others have expressed concerns about doing so. Most notably, Sen. Joe Manchin (D-WV) is pushing for a new requirement that parents work in order to be eligible for the credit. “Tax credits are based around people that have tax liabilities. I’m even willing to go as long as they have a W-2 and showing they’re working,” he told Insider.

With the long-term fate of the credit unclear, the JCT estimates factoring in its expiration after four years opened the door for Republicans to claim that the plan violates President Biden’s pledge not to raise taxes on people making less than $400,000 a year.

“You’ll hear today that President Biden doesn’t break his pledge on taxing Americans making less than $400,000, but that’s false as well,” said Rep. Kevin Brady of Texas, the top Republican on the Ways and Means Committee.

Republicans oppose the tax plan and have warned that it will hurt the middle class as well as businesses large and small. Brady on Tuesday argued, as many economists do, that the corporate tax increase would be felt by individuals, too: “As you know, businesses don’t pay taxes, they collect them. And those burdens land on their workers, lands on their customers, lands on the retirees whose retirement depends on their success, and it lands on the communities that they live in.”

Taxes

Dem Plan Would Cut Taxes for Most, Hit Top Earners Hardest: Analysis

Getty Images