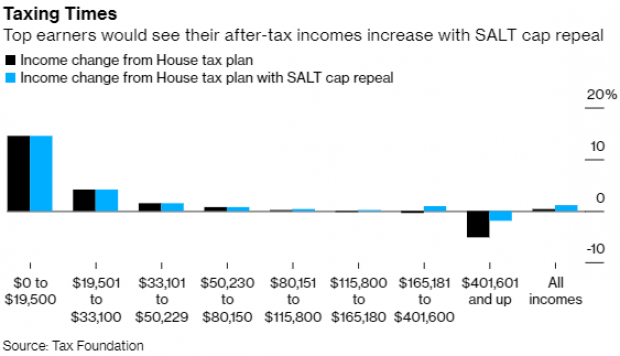

If Democrats’ budget plan restores the full deduction for state and local taxes, it would leave top earners facing much smaller overall tax hikes — or even tax cuts — according to data from the right-leaning Tax Foundation cited by Bloomberg News.

The top 1% of earners, those making more than $401,600, would see their after-tax incomes fall by 5% under the House Democratic plan. But if the $10,000 cap on SALT deductibility is eliminated, their after-tax hit would be just 1.9%. Taxpayers making between $165,181 and $401,600 would see an after-tax hit of 0.3% with the SALT cap in place turn to a gain of 0.9% with the cap lifted.

Restoring the full SALT deduction would cost about $85 billion a year over the next five years, according to the Committee for a Responsible Federal Budget, with most of the benefits of the change flowing to the top 1% of earners.

House lawmakers are reportedly considering options other than a full repeal of the cap, including a two-year suspension or an increase in the $10,000 deduction limit.

Taxes

Restoring SALT Deduction Would Slash Dems’ Tax Hikes for Top Earners: Report

iStockphoto