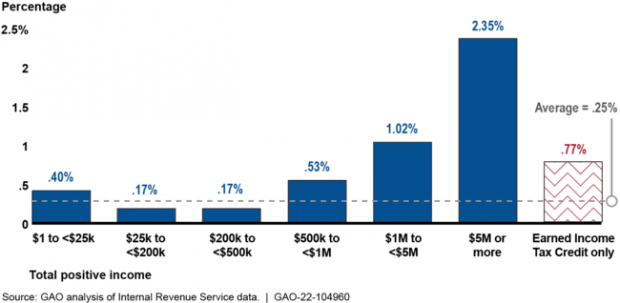

Internal Revenue Service audit rates of individual income tax returns plunged over the last decade, with rates falling the most for taxpayers with incomes of $200,000 and above, according to a report released Tuesday by the Government Accountability Office.

Overall audit rates of individual returns fell from 0.9% to 0.25% from tax year 2010 to tax year 2019. While rates decreased across all income levels, they fell the most for higher-income earners, which IRS officials said was largely because those audits tend to be more complicated and time-consuming. “Average audit hours were generally stable for lower-income returns but more than doubled for incomes of $200,000 and above,” the report notes. “IRS officials cited auditor attrition, major work disruptions, and tax law changes as the primary reasons for the increase in average audit hours.”

Here’s a look at how audit rates fell over the last decade by income range:

* Up to $25,000: down 61%

* $100,000 to $200,000: down 81%

* $200,000 to $500,000: down 92%

* $500,000 to $1 million: down 85%

* $1 million to $5 million: down 87%

* $5 million to $10 million: down 90%

* $10 million or more: down 81%

Audit rates for higher-income taxpayers remained higher than those toward the low end of the income scale, but lower-income taxpayers claiming the Earned Income Tax Credit — a tax break targeted toward low- and moderate-income workers — faced a significantly higher-than-average rate of reviews. That helps explain why taxpayers earning up to $25,000 faced higher audit rates than those earning between $200,000 and $500,000 (see chart below). “IRS officials explained that EITC audits are limited in scope and historically have high rates of improper payments and therefore require a greater enforcement presence,” the report says. For fiscal year 2020, the IRS estimates that $16 billion, or 23.5%, of EITC payments were improper. That has led some Republican lawmakers to call for better designing the credit.

The IRS has faced pressure to ramp up audits of top earners and has started a project to do so. “There cannot be one tax system for the wealthy and one for everyone else. And yet, that is exactly what we have,” Rep. Bill Pascrell (D-NJ), who chairs the House Ways and Means Oversight Subcommittee, said at a hearing Wednesday, according to MarketWatch.

IRS officials have long warned that, after years of budget cuts that have only recently started to be reversed by Congress, the agency is underfunded, understaffed, overwhelmed and “outgunned” by those who seek to avoid paying taxes. The omnibus spending bill for fiscal year 2022 passed by Congress earlier this year provided the IRS with a $12.6 billion budget, a $675 million increase over the previous year —the largest boost for the agency since 2001. The Biden administration has proposed investing $80 billion over 10 years to boost IRS enforcement and upgrade its technology and customer service, but that plan remains in limbo.