The U.S. labor market just won’t quit. Employers added another 253,000 jobs in April, the Bureau of Labor Statistics announced Friday in a report that easily surpassed analyst expectations. The unemployment rate edged lower to 3.4%, matching a low set in 1969.

Wages grew by 0.5% on a monthly basis, the fastest pace since July. On an annual basis, wages rose by 4.4%, slightly higher than the 12-month reading in March.

Still, despite continued strength, the data points to a gradual softening in the labor market. The job growth results for February and March were revised downward, lowering the total for those months by 149,000 jobs. And as strong as it was, April’s job growth was below the average of 290,000 over the previous six months.

A different kind of recovery: Experts continue to marvel at the durability of the economic recovery from the pandemic, even as it gradually softens. The unemployment rate for Black workers hit an all-time low of 4.7% in April, an impressive turnaround from the 16.8% unemployment rate recorded in May 2020, and the gap between Black and white unemployment rates also hit a record low. The labor force participation rate for prime-age workers (ages 25 to 54) rose to 83.3% – above the level recorded just before the pandemic struck and the highest since 2008. And the overall labor force participation rate rose to 62.6%, higher than the Congressional Budget Office’s pre-pandemic forecast for where things would stand in the second quarter of 2023.

“The American labor market is simply unstoppable right now,” said Joseph Brusuelas, chief economist at RSM, who compared the labor market to one of the greatest athletes of all time. “Think of how sports commentators used to describe Michael Jordan,” Brusuelas wrote Friday. “One can’t stop him, one can only hope to contain him. So it is right now with the American labor market.”

Gus Faucher, chief economist at the PNC Financial Services Group, said the report boosts hopes that the economy can achieve the difficult goal of slowing down without falling into recession. “This is what a soft landing would look like, with job growth gradually slowing to a more sustainable pace,” he said, adding that “we won't know whether we've achieved a soft landing probably until the end of this year.”

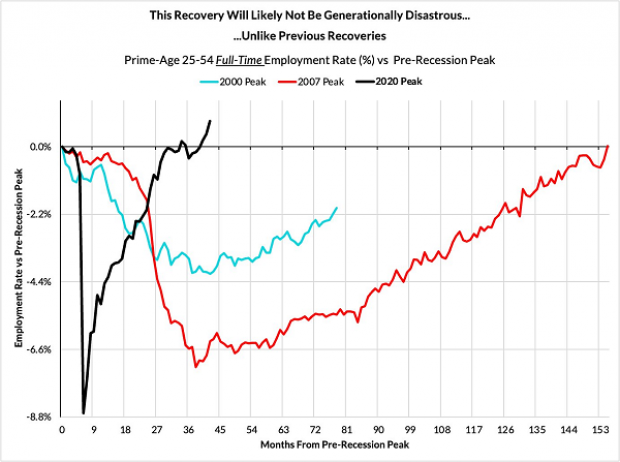

Economist Skanda Amarnath, who leads Employ America, an advocacy group that promotes full employment policies, noted one of the key benefits of the rapid bounce back. “This recovery simply doesn't have the generationally disastrous qualities of the previous two recoveries,” Amarnath tweeted. The recovery after the 2009 financial crisis took more than 10 years, he added, while the post-2001 recovery never reached pre-crisis heights (see the chart below).

The Fed is watching: The report could complicate the inflation-fighting effort by the Federal Reserve, which announced earlier this week what many analysts think will be its final interest rate hike, at least for a while. However, a labor market that continues to show signs of strength could spur Fed policymakers to consider another rate increase when they meet in mid-June.

“Robust jobs numbers in the face of ongoing regional bank stress and debt ceiling uncertainty speaks to the strength of our economy, but it complicates the fight against inflation," said Mike Loewengart of Morgan Stanley. “Today’s strong jobs report may be good news for job seekers, but it may make it more difficult for the Fed.”

Biden celebrates – and warns: Speaking to reporters before a meeting with advisers at the White House, President Joe Biden applauded the report, highlighting the job growth numbers and the decline in the unemployment rate while crediting the good news to his economic policies such as boosting investment in clean energy.

“Tomorrow, it’ll be two years since I signed the American Rescue Plan into law, Biden said. “It led to the fastest recovery of every — any major economy in the world. It laid the foundation for the progress we’ve been seeing and we see today.”

Biden also warned that Republicans were threatening to wreck the economic recovery with their brinkmanship over the debt ceiling. “House Republicans are threatening to undo our economic progress by letting us default on our debt,” Biden said on social media. “It could cost 8 million jobs, threaten retirement savings, and put us in recession. And the middle class would be hit the hardest.”