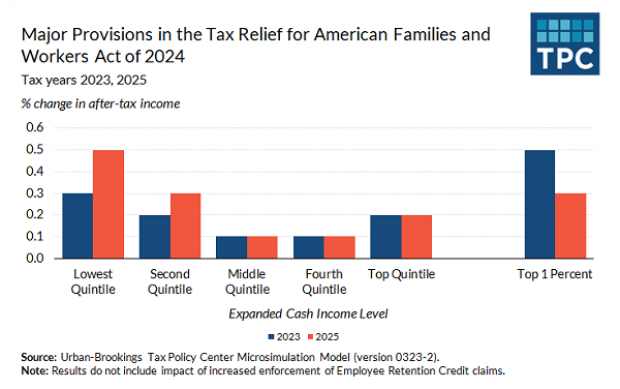

The proposed tax package unveiled last week by House Ways and Means Committee Chairman Jason Smith and Senate Finance Committee Chairman Ron Wyden would provide outsized benefits to two groups at opposite ends of the income spectrum: the poorest 20% of households and the wealthiest 1%.

The Tax Relief for American Families and Workers Act of 2024 would boost the value of the child tax credit, helping low-income households with children. It would also provide more generous tax breaks for corporate research and development and equipment purchases, boosting incomes among shareholders at the top of the income ladder.

According to a distributional analysis by the Urban-Brookings Tax Policy Center, the bottom 20% of households (below $29,800 per year) would see an after-tax increase in income of $60 on average on their 2023 tax returns, or 0.3% more; that boost would rise to about $90 by 2025, or 0.5% more.

At the high end, the top 1% (incomes above $980,000 per year) would see an average boost of $9,500, or 0.5%, in 2023. That benefit would decrease to about 0.3% on average by 2025, due to timing issues associated with the use of business tax credits.