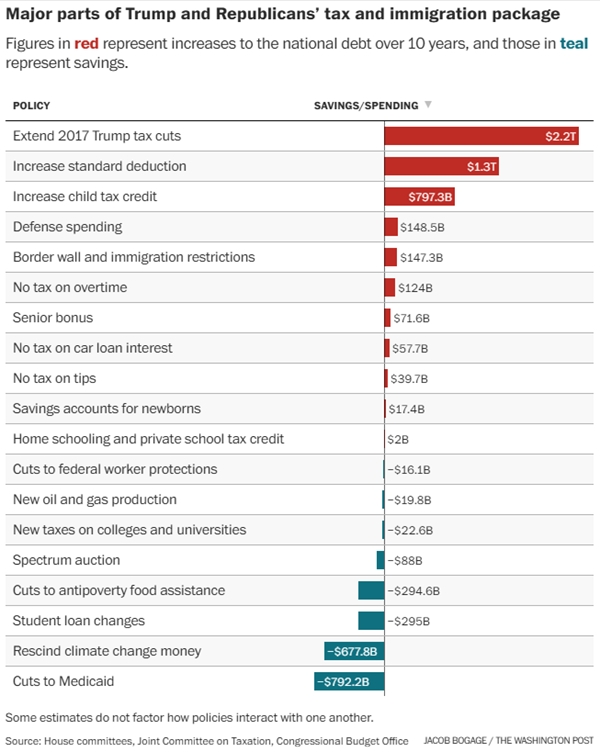

Running more than 1,100 pages, the Republican reconciliation bill passed by the House today includes trillions in tax cuts and hundreds of billions in spending increases, as well as a smaller but still significant amount of spending reductions and other offsets. The chart below from The Washington Post’s Jacob Bogage summarizes some of the major components of the bill, including the single largest element: the extension of the 2017 tax cut package, which comes with a cost of roughly $2.2 trillion over 10 years.

The bill would also increase the standard deduction, which was doubled under the 2017 tax law, adding another $2,000 per couple filing jointly and half that for single filers for the next four years, at a cost of $1.3 trillion. An increase in the child tax credit from $2,000 to $2,500 would cost about $800 billion.

Smaller tax breaks, some added to satisfy pledges made by President Trump, are sprinkled throughout the bill, including the elimination of federal income taxes on overtime (costing $124 billion over 10 years) and tips ($40 billion), tax deductions for car loan interest rates ($58 billion), and a $4,000 increase in the deduction for seniors ($72 billion), which takes the place of a promised cut in taxes on Social Security income. New $1,000 savings accounts for newborns, with the name changed from MAGA accounts to Trump accounts in the final version of the bill, would cost $17 billion.

House Republicans also agreed to raise the state and local tax (SALT) deduction from $10,000 to $40,000, a move that would save money relative to the baseline in which the cap expires. The change costs $320 billion more than the leaving the cap at $10,000 and roughly $660 billion more than allowing the cap to expire, according to an estimate by the Tax Foundation.

The GOP bill includes more than $1 trillion in offsets, led by cuts to Medicaid, which have been estimated to save more than $700 billion. The bill would establish new work rules for Medicaid beneficiaries, tighten eligibility requirements and punish states that provide healthcare to undocumented residents, resulting in 7.6 million more people going uninsured by 2034.

The bill would also phase out or repeal green energy tax credits, including a $7,500 credit for electric vehicle purchases, saving more than $600 billion. Changes in the student loan program would save nearly $300 billion, and new taxes on colleges and universities would raise $23 billion.

Overall, the plan would increase deficits by about $2.3 trillion over 10 years, according to a preliminary analysis of an earlier version of the bill by the Congressional Budget Office. The Committee for a Responsible Federal budget said that, including rising interest costs on the national debt, the tally grows to $3.1 trillion. Once updated to reflect the final version passed by the House, the CBO cost estimate is expected to rise.