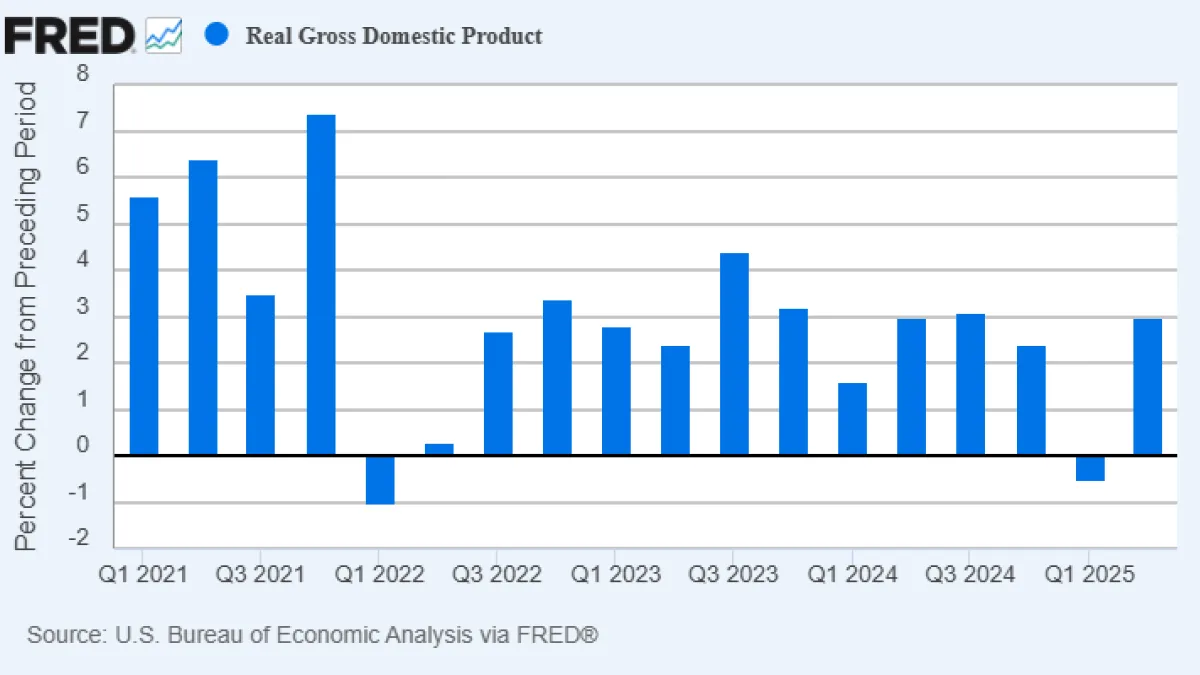

The U.S. economy grew at a faster-than-expected annual rate of 3% from April through June of this year, according to preliminary data released Wednesday by the Commerce Department, but economists warn that healthy headline figure masks weaker underlying trends that may portend a slowdown in the coming months.

On its face, the report suggests a solid economic rebound after gross domestic product shrank at a 0.5% annual rate over the first three months of the year. In a social media post, President Donald Trump hailed the growth as “WAY BETTER THAN EXPECTED!” and used it to again press Federal Reserve Chair Jerome Powell to lower interest rates.

But the gross domestic product growth data for both the first and second quarters were distorted by special factors — most notably Trump’s trade war, which caused swings in imports and exports as businesses scrambled to build up inventories ahead of expected tariff increases. Economists said Wednesday’s data suggests that growth over the first half of the year has been sluggish as the economy contends with challenges and uncertainty caused by the president’s protectionist policies. “Headline numbers are hiding the economy’s true performance, which is slowing as tariffs take a bite out of activity,” Nationwide chief economist Kathy Bostjancic wrote, per the Associated Press.

Imports subtract from growth in the calculation of GDP — after all, the “D” stands for domestic — and a 30% drop in imports over April, May and June added more than 5 percentage points to growth. At the same time, a drop in inventories after the first quarter build-up sliced 3.2 percentage points from growth. Together, net exports and inventories boosted GDP growth by 1.8 percentage points in the second quarter after acting as a 2-percentage-point drag in the first quarter, according to Goldman Sachs economists.

Consumer spending increased at a modest 1.4% annualized pace in the second quarter, in line with expectations and up from a 0.5% rate in the January-March quarter. But a key measure of economic activity that tallies consumer spending and gross private fixed investment increased 1.2% in the second quarter, the weakest since the end of 2022 and down from 1.9% in the first quarter.

Overall, economic growth averaged 1.25% in the first half of the year, a marked slowdown from the 2.8% GDP growth in 2024. "The picture is not pretty, an own goal by U.S. policymakers," said Freya Beamish, chief economist at TS Lombard, according to Reuters. "An economy that was purring along, defying expectations of a slowdown, has been placed on hold."

Federal outlays fall again: Federal government spending fell for the second straight quarter, dropping at a 3.7% annualized rate after falling at a 4.6% clip in the first quarter. Nondefense spending fell at an 11.2% annual rate in the April-June quarter. The drops likely reflect the Trump administration’s DOGE spending cuts.

Inflation remains muted: The Federal Reserve’s preferred measure of inflation, the personal consumption expenditures, or PCE, price index, rose at a 2.1% annual rate in the second quarter, down from 3.7% in the first quarter. The core PCE price index, which excludes volatile food and energy prices, rose 2.5%, compared with a 3.5% increase the prior quarter. More detailed data on inflation and spending for June is due out tomorrow.

The bottom line: Trump’s economy may be more tepid than the strong GDP report suggests.