Trump’s Tariffs Are About to Clobber US Consumers

President Trump on Monday gave U.S. and Chinese negotiators another 90 days to reach an agreement on trade, delaying a set of sky-high tariffs that threaten to upend commerce between the world’s two largest economies. But even with the delay, U.S. consumers are starting to feel the pinch of Trump’s aggressive trade war — and the pinch is about to get a lot more painful.

A bit of breathing room: As part of his ongoing effort to rewire global trade to favor the U.S., Trump in April imposed tariffs as high as 145% on Chinese imports, with China responding by raising its own tariffs and cracking down on the export of rare earth materials to the U.S. The two sides agreed to a 90-day truce in May that was scheduled to expire tomorrow but is now extended into November.

Although the crippling tariffs Trump has threatened are now on hold, Chinese exporters are still facing higher tariffs than they did before Trump took office. Most imports from China face a 10% base tariff, plus a 20% punitive tariff due to China’s alleged role in the fentanyl crisis.

Consumers will pay: The tariffs on China, along with a host of other import duties on trading partners around the world, are pushing prices higher in the U.S. economy. According to a new analysis by Goldman Sachs, those price hikes have been muted so far — but they’re about to get much worse, with U.S. consumers bearing the brunt of the economic pain.

In a research note released this past weekend, Goldman analyst Elsie Peng said that U.S. businesses have absorbed most of the costs of new tariffs imposed by Trump this year, but that’s expected to change over time. In an analysis running through June, U.S. importers were found to have covered 64% of the cost of the tariffs, with consumers accounting for just 22%. Exporters covered the rest, largely by lowering their prices.

Starting in the fall, as many of the higher tariffs threatened by Trump take effect, the consumer share of the tariff cost is expected to rise to 67%, the Goldman analysts said, while the share for U.S. businesses will fall to 8%. The remaining 25% will be absorbed by foreign exporters.

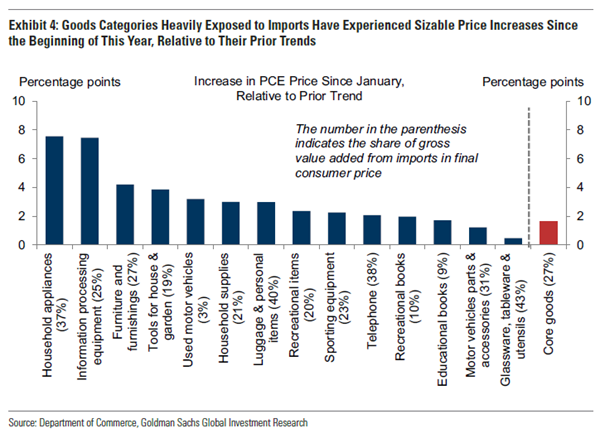

However the burden finally falls, it’s clear that tariffs are already starting to have an effect on prices, even if that effect is smaller so far than many economists feared earlier this year, when Trump initiated his tariff offensive (see the chart below). The Goldman analysts estimate that the tariffs have raised prices as measured by core PCE — a pricing index that ignores volatile food and fuel prices — by 0.2% through June. By the end of the year, tariffs are projected to add another 0.66%, leaving the core PCE inflation rate at 3.2%. Without the tariffs, the analysts estimate that the inflation measure would be 2.4%.

Importers warn: An apparel retailer described to The New York Times how the tariffs have affected him so far — and why they will drive retail prices sharply higher in the coming months.

Barry Barr, who owns KAVU True Outdoor Wear based in Seattle, said he avoided raising prices on his goods for the fall, even though he is paying more for the products he ordered from factories in China, India and Vietnam, all of which have been hit with high tariffs. Although he raised prices scheduled for 2026, Barr has been waiting to see how the tariff conflict plays out, hoping that Trump delays or changes his mind, as he has done in the past. But now that many of the full tariffs have taken effect — raising the 10% base tariff applied to most countries over the last few months much higher, including a 46% import tax on goods from Vietnam — Barr said he will have to raise prices aggressively and perhaps lay off employees.

“There’s absolutely no way I can make a profit this year absorbing all these tariffs,” Barr told the Times. “It’s bigger than any tax bill I’ve had to pay.”

In an opinion piece published Monday by The Washington Post, Todd Carmichael, the founder of La Colombe coffee company in Philadelphia, explained why Trump’s tariffs are going to raise prices on a beloved morning ritual for millions of Americans.

Coffee, at the center of an industry that Carmichael says supports 1.7 million jobs, has historically been tariff-free. But in April, U.S. importers started paying a 10% tariff on all coffee imports. As of last week, those tariffs have risen on many coffee-producing nations, including Indonesia and Vietnam. Some key countries may escape new tariffs on coffee, including Mexico and Colombia. But Brazil, the world’s largest supplier, now faces a 50% tariff, in large part due to a political dispute Trump is having with the country’s leaders.

“Brazil provides about 30 percent of the coffee consumed in the United States, so this will massively impact both coffee prices and the industry within U.S. borders,” Carmichael said.

Coffee, Carmichael notes, is a tropical fruit, so there aren’t many options for growing it in the United States. Trump says his tariffs are designed to rebuild U.S. industry, but at least in the case of coffee, it seems like the tariffs will produce only higher prices. “[T]ariffs on coffee make little sense on those terms compared with other goods,” Carmichael wrote. “Because the United States can’t grow much coffee itself, all Americans get is upward pressure on prices without a boost to jobs.”