- “People like myself should be paying a lot more taxes.” - Warren Buffett, chairman and CEO, Berkshire Hathaway

- “Rich people aren’t paying enough.” - Bill Gates Sr., co-chair, Bill and Melinda Gates Foundation

- “I’m rich; tax me more.” - Garrett Gruener, founder, Ask.com

- "I don't understand why my tax rate didn't go up.” - Alan C. “Ace” Greenberg, former chairman, Bear Stearns

- “It’s so clear what’s needed. But because of the political debate, which the administration has lost, we are going to follow the wrong policy by extending the Bush tax cuts.” - George Soros, Soros Fund Management

Even Pete Peterson, who funds The Fiscal Times, advocates raising taxes on the rich. Since the debate over the Bush tax cuts seemed to have some billionaires and millionaires begging to be taxed more, maybe it’s time for them to put their money where their mouths are.

So, for the fat cats who are quoted above, and the millionaires and billionaires below who have signed pledges against extending the tax breaks for the wealthy through the organizations Wealth for the Common Good and Patriotic Millionaires for Fiscal Strength, The Fiscal Times has decided to put them to the test. We’re asking them to pay the amount they would have paid to Uncle Sam if the Bush tax cuts had expired. For Mr. Buffett, that’s $4.3 million more, based on his $46 million income from 2006. Not a small chunk of change to help bring down the growing deficit.

According to the IRS, the top 400 earners in the U.S. grossed a whopping $137 billion in 2007 (the latest data available). A household making $50,000 a year is taxed at 17.4 percent, assuming no write-offs. Yet the billionaires were only taxed an average rate of 16.7 percent, amounting to $22.9 billion. If the Bush tax cuts had expired, this would have gone up to about 27 percent or $36.4 billion. The low 16.7 percent rate assumes about two-thirds of the top 400’s annual income is derived from capital gains, which are taxed at 15 percent under the current Bush-era tax code. To break it down: the top tax rate — i.e. anything above $380,000 — would rise from 35 percent to 39.6 percent , the capital gains rate from 15 percent to 20 percent, and the dividends tax rate from 15 percent all the way up to the ordinary income rate of 39.6 percent. So two thirds of $137 would be taxed at 20 percent; one third at 39.6 percent.

To illustrate what’s been paid compared to what’s owed, we have used two simplified metrics to calculate the difference between the rates under the Bush tax cuts vs. if they had expired.

So: $90,420,000,000 would be taxed an additional 5 percent = $4.5 billion. The tax on the remaining third, which includes dividends, would go up about $4 billion.

Total: $8.6 billion. Divided by 400, that’s an average of $21 million each.

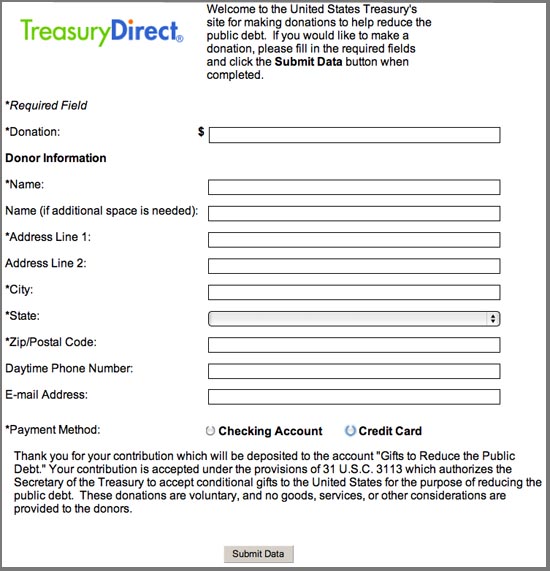

That seems like a solid start to deficit reduction. But wait, there’s more. Luckily for them, paying up is easy. Anyone can make a charitable donation to the government through the Treasury Department’s “Gift to Reduce the Public Debt” program, and given our fiscal crisis, the U.S. certainly qualifies as a worthy charity. The best part? It’s tax deductable — the government’s gracious way of saying “thank you.”

Patriotic Millionaires for Fiscal Strength (advocates for an increase in taxes for those who earn more than a million dollars)

CYNDA COLLINS ARSENAULT

Superior, CO

RENE BALCER

Los Angeles, CA

LAWRENCE BENENSON

New York, NY

DANIEL BERGER

Philadelphia, PA

NANCY BLACHMAN

Burlingame, CA

Continued on next page

BRADY BRIM-DEFORE

ST Los Angeles, CA

ROBERT S. BOWDITCH JR.

Brookline, MA

DAVID A. BROWN

Berkeley, CA

MARK BUELL

San Francisco, CA

RICHARD CARBONE

Williamstown, NJ

DOUG CARLSTON

San Rafael, CA

DAVID CHIANG

Las Vegas, NV

BEN COHEN

San Francisco, CA

BILL COLLINS

Buffalo, NY

TOM CONGDON

Denver, CO

ROB DAHLE

Salt Lake City, UT

DAVID DESJARDINS

Burlingame, CA

DOUG EDWARDS

Los Altos, CA

PAUL AND JOANNE EGERMAN

Boston, MA

BOB EPSTEIN

Berkeley, CA

RONALD FELDMAN

New York, NY

JERRY FIDDLER

Berkeley, CA

JOSEPH M. FIELD

Bala Cynwyd, PA

CHRISTOPHER FINDLATER

Naples, FL

CHARLIE FINK

Washington, DC

ERIC FREDRICKSEN

Los Gatos, CA

DAVID FRIEDMAN

Longmont, CO

GAIL FURMAN

New York, NY

RON GARRET

Emerald Hills, CA

BILL GAWTHROP

Yorkville, CA

DAVID GOLDSCHMIDT

Princeton, NJ

JOSHUA GORDON

Las Vegas, NV

GARRETT GRUENER

Oakland, CA

DOUG GULLANG

Wayne, IL

RICHARD GUNTHER

Los Angeles, CA

PAUL HAGGIS

New York, NY

NICK AND LESLIE HANAUER

Seattle, WA

SUZANNE AND LAWRENCE HESS

San Diego, CA

ARNOLD HIATT

Boston, MA

LEO HINDERY, JR

New York, NY

BILL JANEWAY

New York, NY

JOHN S. JOHNSON

New York, NY

MELISSA JOHNSEN

Kirkwood, MO

ROB JOHNSON

New York, NY

WAYNE JORDAN

Oakland, CA

WILLIAM JURIKA

Piedmont, CA

JOEL KANTER

Vienna, VA

JOSHUA KANTER

Sandy, UT

ROCHELLE KAPLAN

Salt Lake City, UT

RAVI KASHYAP

Franklin, TN

JOHN KATZMAN

New York, NY

JOHN KORTENHAUS

Plano, TX

DAVID LAZARUS

Queenstown, MD

ROB AND DIANE LIPP

Los Angeles, CA

ART LIPSON

Salt Lake City, UT

EUGENE LONG

Plymouth Meeting, PA

MICHAEL MARKS

Red Bank, NJ

MARIO MORINO

Rocky River, OH

WIN MCCORMACK

Portland, OR

DENNIS MEHIEL

New York, NY

HERBERT MILLER

Washington, DC

VIBHU MITTAL

Palo Alto, CA

MOBY

New York, NY

WILLIAM J. MORAN

New York, NY

CHRIS NELSON

Barrington, RI

PETER NORVIG

Palo Alto, CA

LARRY NUSBAUM

Phoenix, AZ

FRANK PATITUCCI

Pleasanton, CA

MORRIS PEARL

New York, NY

GREGORY RAE

New York, NY

BERNARD RAPOPORT

Waco, TX

GREAT NECK RICHMAN

New York, NY

JONATHAN ROSE

New York, NY

GUY AND JEANINE SAPERSTEIN

Piedmont, CA

HEIKE SCHMITZ

Palo Alto, CA

DAVID SCHROEDERS

Sarasota, FL

SYBIL SHAINWALD

New York, NY

SUSAN SHORT

New York, NY

CRAIG SILVERSTEIN

Mountain View, CA

MICHAEL STEINHARDT

New York, NY

SANDOR AND FAYE STRAUS

Lafayette, CA

SUNIL TOLANI

New York, NY

PHILLIPE AND KATHERINE S. VILLERS

Concord, MA

SCOTT WALLACE

Washington, DC

DAVID WALKER

Bridgeport, CT

DAVID AND VINITHA WATSON

Oakland, CA

GEORGE ZIMMER

Piedmont, CA

Wealth for the Common Good:

Initial group of signers who would pay the tax:

- Chuck Denny, Jr., retired CEO, ADC Communications, MN

- Arul Menezes, principal architect at Microsoft, WA

- Bernard Rapoport, Chairman Emeritus, American Income Life Insurance Co., TX

- William Collins, former mayor of Norwalk, Conn. & CEO of Minuteman Media, CT

- Todd Achilles, managing member at Balius Ventures LLC, WA

- Jody Wiser, Tax Fairness Oregon, OR

- John Steel, former mayor of Telluride, Colo. & attorney, CO

- Eric Schoenberg, private investor and professor at Columbia University, NJ

- Albert Francke, independent director of companies, NY

- David Krakow, school teacher, DC

- Stan Storscher, legislative director, SPEEA, IFPTE Local 2001, WA

- John Burbank, director, Economic Opportunity Initiative, WA

- Susan Estep, financial advisor, MT

- Kris Alman, former physician and activist, OR

- Jonathan C. Lewis, CEO of Opportunity Collaboration and Microcredit Enterprises, CA

- John Harrington, Harrington Investments, Inc., CA

- Drummond Pike, CEO, Tides Inc, CA

- Roy Ulrich, Attorney and radio Hostels.com, CA

- Michael Sherraden, Center for Social Development, MO

- Paul Grundy, IBM Corporation’s Global Director, IBM Healthcare Transformation, NY

- Sandee Stewart, Sandee Stewart Television, CA

- Rene Balcer, writer and producer, CA