• 3.5 to 4 percent growth could cut the jobless rate by one full point next year. • Despite the Fed’s Treasury purchases, 10-year yields are up one percentage point. • Oil prices are up 11 percent this year and hovering at about $90 a barrel. |

The Federal Reserve’s wish list for 2011 is no secret. It includes faster economic growth, lower unemployment, an end to falling inflation and a freer flow of credit. Chances are the Fed will get all four, but that doesn’t necessarily mean it will be an easy year for Ben Bernanke & Co.

After grinding through much of 2010, the U.S. economy appears to be switching to a faster track, mainly reflecting the new stimulus for consumer and business spending from the tax compromise that kicked in on January 1st. Even before that, the fourth quarter was already showing considerably more momentum, with many economists believing growth accelerated to about 4 percent. Long-time bears on the economy are grudgingly bumping up their 2011 forecasts by more than a percentage point into the 3.5-4 percent range. Growth at that pace would help to achieve much of what the Fed would like to see.

Even so, policymakers know the risks to the recovery’s sustainability are persistent and offer good reason for policy to err on the side of caution. Leading the list is Europe’s sovereign debt crisis, an intensification of which could fuel more risk aversion and tighter financial conditions. Then there is China, where monetary authorities are trying to limit inflation by raising interest rates, which could cut into global growth prospects. Housing and the imbalance between supply and demand add to worries about another downdraft in home prices, which could further erode consumer wealth and create new problems for the credit markets. Finally, state and local finances will garner much attention, especially in the municipal bond market, as federal aid wanes and budget pressure remains intense.

These risks are the chief reason why most economists believe the Fed will not stop short of its full plan to buy $600 billion in long-term Treasury securities by the end of June, even if the economy performs up to its brighter expectations. However, that plan has already met with criticism in some corners of the markets and even within the Fed itself. Some Fed watchers think that, absent a big drop in unemployment, the Fed could opt for yet a third round of purchases. Such a move would surely precipitate even more Fed bashing, especially from some policymakers in Congress, who would like to hold the Fed more accountable for its policy actions.

Even if everything goes right in the economy, the Fed will still face some tough decisions on where policy should go from here, given that the central bank’s purchases of Treasury securities are already financing a large portion of Washington’s budget deficit. With the additional red ink in the tax deal, economists have bumped up their 2011 deficit projections by about $230 billion. Even in a stronger economy, the shortfall would remain close to 9 percent of GDP, about the same as in 2010, and it would imply an even larger supply of new Treasury issues hitting the market. When the Fed’s Treasury purchases stop, less demand could push benchmark Treasury yields higher.

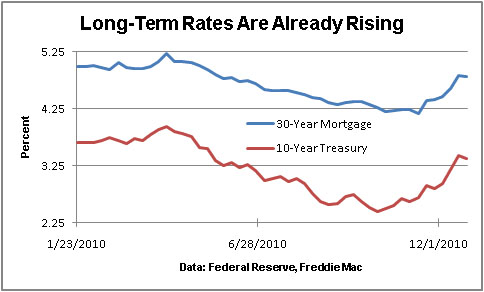

Rising Treasury yields would add to upward pressure on mortgage rates and other borrowing costs. Already, the yield on 10-year Treasuries has risen nearly a full percentage point since early October, to 3.5 percent on December 28, and the average 30-year mortgage rate is up more than a half point, to 4.81 percent on December 23. The question is whether housing and the economy can bear up under even higher rates later on.

A pickup in economic growth into the 3.5-4 percent range would strongly suggest that the recovery is solid and supportive of one of the Fed’s key objectives — reducing unemployment. Economists generally agree that growth in that range will generate, on average, monthly payroll gains in the private sector of more than 200,000. That would be twice the 2010 pace and enough to cut the jobless rate by about a full percentage point, from 9.8 percent in November, while adding greatly to household income growth.

Both consumers and business will receive key support from the tax deal, which extends the Bush tax cuts, continues emergency jobless benefits, and cuts payrolls taxes, while offering businesses incentives to boost their capital expenditures and expand their operations. The 137 CEOs polled by the Business Roundtable in the fourth quarter were the most optimistic in five years. New fuel for spending comes at a time when consumers have already made great strides in lifting their savings and reducing their debts. Plus, the Fed’s fourth-quarter survey of bank loan officers shows that banks are increasingly willing to make loans to households and that they have eased their lending standards for consumer loans outside of mortgages.

Stronger growth, however, would also fuel worries about future inflation. Most policymakers expect core inflation, which excludes energy and food, to remain below the Fed’s comfort zone of about 2 percent or so, through 2013. Below that zone, the risk of deflation rises. Many private forecasters, however, think prices are set to increase faster than the Fed expects, as the economy accelerates. Oil prices are already up about 11 percent this year, and other commodity prices continue to soar.

Annual core inflation ticked up in November, and economists at Morgan Stanley believe a combination of higher inflation expectations and a narrowing of slack in the markets for goods and services will lift it further in the coming year. Analysts at Barclays Capital agree, and they look for strong global and emerging-market growth to put further upward pressure on energy and food prices, as well, adding to the overall inflation rate.

Yet a slow rise in inflation toward policymakers’ comfort zone is part of the Fed’s wish list for 2011. Plus, investors seem likely to benefit. China and other emerging markets have a genuine inflation problem and are dangerously close to overheating. Moreover, given the stress on Europe and continued problems in Japan, the U.S. is set to outperform other developed economies. While the risks for the economy in 2011 are clear, policy efforts by both the Fed and the White House seem likely to make the U.S. a more attractive place to invest next year.