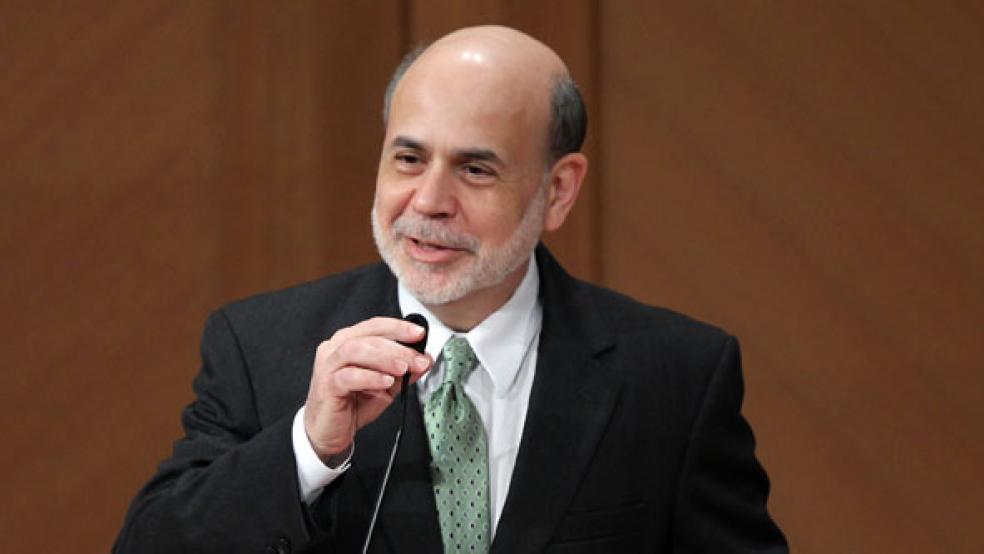

Saying the pace of economic recovery will remain uneven for the rest of the year, Fed Chairman Ben Bernanke on Tuesday ruled out any increase in interest rates until new hiring picks up.

“With the effects of the Japanese disaster on manufacturing output likely to dissipate in coming months, and with some moderation in gasoline prices in prospect, growth seems likely to pick up somewhat in the second half of the year,” he told a conference of international bankers meeting in Atlanta. “Overall, the economic recovery appears to be continuing at a moderate pace, albeit at a rate that is both uneven across sectors and frustratingly slow from the perspective of millions of unemployed and underemployed workers.”

While Bernanke repeated his usual plea for a long-term plan to address chronic budget deficits, he cautioned against any short-term budget cuts that might tip the economy back into recession. “A sharp fiscal consolidation focused on the very near term could be self-defeating if it were to undercut the still-fragile recovery,” he said.

The Fed’s determination to keep interest rates near zero is likely to antagonize central-bank critics who believe very low rates coupled with the U.S. policy of purchasing government securities, known as quantitative easing, is sowing the seeds rapid inflation down the road and has weakened the dollar in the near term. A weaker dollar makes U.S. purchases abroad more expensive.

Bernanke spent a large portion of his prepared comments debunking both charges. Every indicator of medium and long-term inflation expectations “remains reasonably stable,” he said, adding that the increase in global commodity prices could largely be attributed to increased demand from rapidly growing economies like China, India and Brazil. “The Fed will continue to closely monitor the evolution of inflation and inflation expectations and take whatever actions are necessary to ensure inflation is controlled.”

And as for the weakening dollar, he pointed out that it was only by comparison to the dollar’s value at the trough of the financial crisis, when foreign investors saw the U.S. economy as a safe haven in a troubled world and bought U.S. Treasury bonds, thus temporarily driving up the value of the dollar.

“Yes, the dollar is down 15 percent since 2009,” he said, “but oil is up 160 percent and non-fuel commodity prices are up 70 percent . . . As the U.S. is a major oil importer, any geopolitical or other shock that increases the price of oil will worsen our trade outlook, which depresses the dollar. In this case, commodity prices affect the dollar, not the other way around.”

The Fed chief said households across the U.S. were being buffeted by strong and countervailing winds. Private-sector hiring has picked up over the past six months, payroll taxes have been reduced, and retirement savings have rebounded from recessionary lows. On the other hand, higher energy and food prices, while transitory, have taken a short-term toll on family finances.

Moreover, hours worked for those employed remain 6.5 percent below their pre-recession peak. During the 1981-82 downturn, Bernanke said, hours worked never fell more than 6 percent off their pre-recession highs. And for those who remain unemployed, he expressed fears that they may never regain a foothold in the job market. “Their skills tend to deteriorate over time and employers are reluctant to hire the long-term unemployed,” he said.

As could be expected at a bankers’ conference, the Fed chief got an earful about the nearly 300 new regulations that are coming from the federal regulatory agencies implementing the Dodd-Frank act. During the question and answer session, JPMorgan Chase CEO Jamie Dimon suggested “someone is going to write a book in 20 years that looks at all the things we did that slowed us down coming out of this crisis.”

“Most of the bad actors are gone,” Dimon said. “Off-balance sheet businesses are virtually gone; a lot of insurers that insured them are gone; most exotic derivatives are gone; there’s far more transparency; Fannie Mae and Freddie Mac are in the government hospital . . . regulators, I can assure you, are much tougher; mortgage underwriting {has] gone back to where it was 30 years ago. . . Has anyone studied the cumulative impact of these things? Is this holding us back at this point?”

“The crisis revealed lots of problems,” Bernanke said with a laugh. “You didn’t mention three or four others I could think of.”

There was a tension, Bernanke said, between developing a new regulatory framework for banking that guards against systemic breakdowns like the one that almost dragged the U.S. into a second great depression and maintaining a solid system to extend credit and other financial services to the business community. Tradeoffs are inevitable.

“It’s probably going to take a bit of time to figure out where the costs exceed the benefits and make the appropriate adjustments,” he said.

Related Links:

Fed Policy Revealed as Media Grill Bernanke (The Fiscal Times)

Discord at Fed Has Bernanke Out on a Limb (The Fiscal Times)

Bernanke Warns of Dire Effects of Unsustainable Deficit (The Fiscal Times)

Bernanke Defends Stimulus; Takes Boehner to Take (The Fiscal Times)