Spring hasn’t officially arrived yet, but the economy sure seems to be in bloom. Housing prices are climbing. The $16 trillion in net worth lost by American households during the Great Recession has officially been regained. Increasingly confident consumers are spending, and borrowing, more. Business spending has picked up after a lackluster end to 2012, too. Blue-chip stocks have reached all-time highs – and then kept right on going, rising to even higher levels.

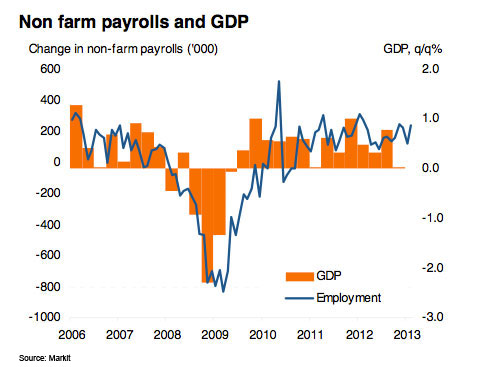

One after another, the data points have largely signaled improving economic health, with Friday’s jobs report for February among the strongest and most important signs. Private sector payrolls grew by 246,000 last month, bringing the average gain for the last four months to 205,000 – well above the pace of previous months. The unemployment rate fell from 7.9 percent to 7.7 percent, its lowest level since December 2008. And wages have finally started to edge higher. “The composition of job growth in February was more favorable – leaning toward the higher-paying industries,” says Ryan Sweet, senior economist at Moody’s Analytics. “Stronger wage gains will help cushion consumers over the next couple of months.”

In all, February’s jobs data was “unequivocally strong,” as UniCredit chief economist Harm Bandholz put it. The report showed a broadening improvement in hiring, with sector after sector posting solid gains. Professional and business services – an umbrella that covers everything from accounting and office administration to architecture, advertising and computer systems development – added 73,000 jobs in February and 488,000 jobs over the last 12 months, for example. Construction, a sector battered by the housing bust, added 48,000 jobs in February and 140,000 jobs over the last year.

“What these numbers do tell us,” wrote Chris Williamson, chief economist at Markit, after Friday’s jobs report, “is that the economy is moving in the right direction and is weathering the storm of various fiscal headwinds it is currently facing with considerable resilience.”

Job Gains By Sector | ||

| Sector | Jobs Added in February | Jobs Added Over Last 12 Months |

| Professional and business services | 773,000 | 488,000 |

| Construction | 48,000 | 140,000 |

| Leisure and hospitality | 24,000 | 323,000 |

| Health care | 32,000 | 301,000 |

| Retail | 23,700 | 252,000 |

| Manufacturing | 14,000 | 107,000 |

| Source: Bureau of Labor Statistics | ||

The road to a full economic and jobs recovery remains a long one, though. Unemployment in October 2007, when the stock market was last hitting such highs, was at 4.7 percent. Today, 12 million Americans are still out of work, with 40 percent of them, or 4.8 million, jobless for 27 weeks or more. Another 8 million workers are employed part-time because they can find full-time jobs, and 130,000 people dropped out of the labor force in February, dropping the labor force participation rate to 63.5 percent. The economy is still 3 million jobs short of where it was at the start of the Great Recession, and even if we maintained February’s impressive growth rate, the unemployment rate wouldn’t return to pre-recession levels until mid-2017.

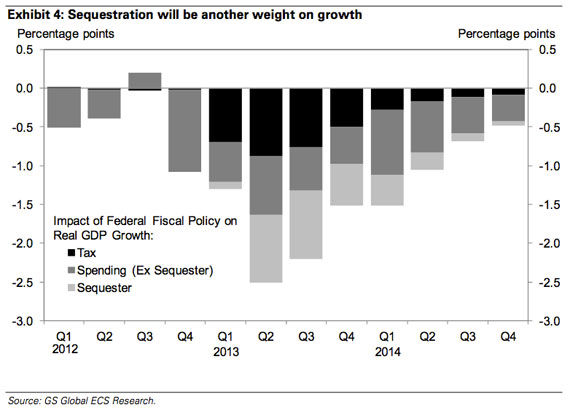

There are reasons to worry, though, that the momentum apparent in the February jobs report won’t be sustained in coming months. Ask economists what could derail the economic improvements and they'll likely point first not to China or Europe but to Washington, D.C. and the sequestration budget cuts that took effect this month following the expiration of the payroll tax holiday at the beginning of the year. The full effects of those changes have yet to be seen. “The biggest risk is fiscal policy being too tight too quickly,” says Sweet of Moody’s Analytics.

The economy will be able to digest the fiscal cuts from Washington without tumbling into recession. Even so, says economist Ben Herzon of Macroeconomic Advisers, the economy is probably not strong enough to withstand those cuts and keep creating jobs at a pace that will lower the unemployment rate much over the full year. “Ideally, fiscal restraint the stabilizes the debt-to-GDP ratio and puts it on a downward track,” Herzon says, but “you would want that restraint ramping up in the context of an economy that could still create enough jobs to put the unemployment rate on a downward track.”

The Federal Reserve’s low interest rates and quantitative easing have helped offset those fiscal fears thus far. “Monetary policing is trumping fiscal policy in the economy and financial markets,” UBS economist Maury Harris noted in a report released early last week, before the jobs numbers reinforced the point. “The Fed’s current quantitative easing (QE) policy of buying $85 billion in Treasury and mortgage securities per month swamps the $85 billion sequester for the fiscal year 2013.”

Economists still expect the drag from the budget cuts and tax increases will be felt before long, though. “We’re going to see likely layoffs among defense manufacturers because of the sequester,” says Sweet. “The furloughed government workers will still show up in the employment numbers, but they’re going to take a pay hit and that’s going to weigh on consumer spending and have a spillover effect on the broader economy.” That means the economy appears likely to repeat its seasonal patterns of the last two years, with a strong winter followed by weakness in spring and summer and then signs of growth to end the year.

“If the sequester lasts for the whole year, we think it will take around 400,000 off the job count by year-end, a significant impact but not enough to derail the private sector recovery,” Nigel Gault, chief U.S. economist at IHS Global Insight, wrote Friday. In all, economists anticipate the sequester to trim 0.6 percentage points from GDP growth this year, with the effects felt most strongly in the second and third quarters. That loss, combined with a similar or higher amount resulting from the tax increases, could pare about 1.5 percentage points of growth from the economy this year. If not for those two major sources of fiscal drag, GDP growth would be above 3 percent this year, economists project.

Instead, the newly imposed fiscal tightening means that the jobs reports in coming months may not be able to match the strength seen in February. Without the sequester, Sweet says, job gains of around 200,000 a month should be sustainable – and that sustained pace over a full year is needed to make a bigger dent in the unemployment rate.