Oh, how the worm has turned. The Dow Jones Industrial Average tested below the 16,000 level on Wednesday for the first time since February before rebounding to close at 16141.74. The Dow has now wiped out more than 1,100 points in less than a month. Treasury bond yields are collapsing as investors lose faith in the economy (on the heels of a weak U.S. retail sales report) and the outlook for inflation.

The 10-year Treasury yield dropped below 2 percent, to levels not seen since early 2013. Japan's Nikkei Average is back below the 15,000 level. Crude oil is plummeting towards $80 a barrel. And gold and silver, shunned and forgotten since 2011, are starting to enjoy some safe haven buying interest again.

Related: Stock Market Scare — Could Recession Loom as Profits Drop?

Investors had been lulled into a false sense of security over the last two years, comfortable in the belief that central bankers around the world would "handle" any threat to the global economy and the financial markets. Bond yields pressed to record lows. Prices of stocks and corporate bonds only seemed to go up. Volatility was nonexistent. Hollywood stars dabbled in venture capitalism while my local pizza guy said he was interested in dabbling in currency futures.

Everywhere you looked, there was evidence of bull market excess. Skepticism, by one measure, fell to levels not seen since the 1980s.

All of a sudden, that tranquility has been shattered as central bankers look increasingly toothless, which as I explored in my last post, threatens the foundational theory of this bull market: Cheap money can solve all. Global economic data is rolling over despite the efforts of central bankers, who mostly remain in full-stimulus mode. Only the Fed is inching towards normalization by planning on ending its QE3 bond purchase program later this month, a step that could still be delayed. But the monetary base has never been higher. The Fed is merely slowing the pace of new stimulus, not removing it.

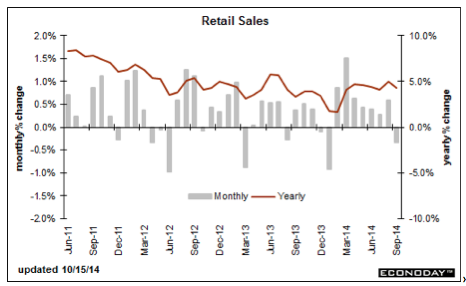

The new problems we face cannot be easily solved. Greek bond yields are blowing out as the Eurozone debt problems start simmering again. Japan is running out of options, caught by a ridiculous 227 percent debt-to-GDP ratio, higher taxes, and a lingering debt-deflation problem. Here at home, economic growth is stalling as housing and retail sales slow even as the job market tightens. The chart below shows how last month's drop in retail sales represents a marked deterioration of the consumer strength seen throughout the year.

Related: Europe’s New Recession Is One Just One of the West’s Problems

Simply printing more money will not solve this. The cheap money junkies are already out chattering about how the Fed could be forced to start a new round of bond-buying stimulus. The problem is that with a $4 trillion-plus balance sheet, and ownership of about a third of all 10-year T-bond equivalents, the more the Fed prints the more distorted and broken the bond market becomes.

Volatility, as measured by the CBOE Volatility Index (VIX), blew above 31 on an intra-day basis on Wednesday to hit levels not seen since 2011 -- a clear indication that investors are beginning to panic and flood into put option protection against further downside risk, pushing up contract prices.

But the ferocity of the shift from greed to fear suggests that, at least on a short-term basis, stocks should see a rebound rally. For investors still in the market, this rebound could be the last opportunity to exit positions ahead of a more protracted decline should the global economic data continue to deteriorate.

Jason Goepfert at SentimenTrader notes that there have been six other times in market history where the VIX is jumped 60 percent or more in three days. They were October 1987, October 1989, August 1990, February 2007, May 2010, and August 2011. Every single time, stocks rallied in the days that followed. In 1990 and 2007, the rebound lasted five to seven days before the market rolled over to new lows.

Geopfert highlights the importance of what traders do during the bounce, should it materialize. Unless we see broad, aggressive buying, he warns that "a much more severe decline is likely."

How severe? The MSCI World (ex USA) Index has returned to levels not seen since September 2013. Global stocks peaked earlier than U.S. stocks, topping out in July and setting a lower high in September. A similar decline in the S&P 500, should the U.S. economy succumb to global weakness, would push stocks down another 12 percent or so from here and would represent a 50 percent retracement of the gains from May 2012 to September 2014.

Top Reads from The Fiscal Times: