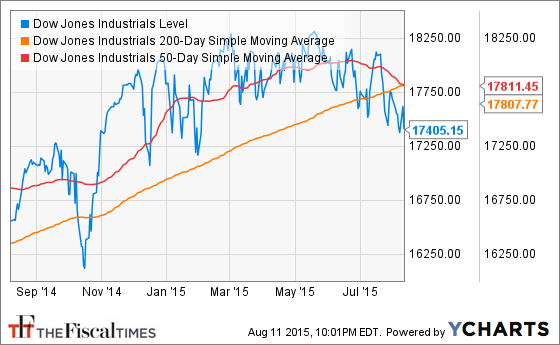

The Dow Jones Industrial Average posted its first "death cross" since 2011 on Tuesday — a technical signal in which the 50-day moving average drops below the 200-day moving average, a sign of a medium-term trend breakdown.

Other markets were hit too. Crude oil tested $42 a barrel for the first time since March, with a drop to 2009 levels looking likely. Gold and silver are perking up. And Treasury bonds are soaring, pushing down bond yields as investors scatter toward safety.

Related: Oil Sector Insiders Signal It’s Time to Buy

The catalyst was a surprise move overnight by the People's Bank of China to devalue the yuan by 1.9 percent in response to weak trade and inflation data over the weekend. This is the largest one-day drop since China ended its dual-currency system in January 1994. And it returns the currency value to where it was in April 2013.

By the looks of things, the turbulence is just getting started.

Many other countries, from Japan to Switzerland and even in European Union, have been monitoring and managing their currency valuations in a bid for growth and economic stability. China's aggressive move will not only send shockwaves throughout the financial system, but potentially affect global geopolitics as well.

Republican presidential contender Donald Trump, for one, has been an outspoken critic of China's trade policies and has labeled the central bank’s move as "devastating" for the United States. (As an aside, 2012 GOP presidential nominee Mitt Romney said he would've, on day one, labeled China a "currency manipulator.")

From their perspective, Chinese central bankers had good reason to push down their currency, with a raft of data pointing to a sharper economic slowdown than Beijing is comfortable with. Over the weekend we learned that exports fell below expectations, dropping 8.3 percent in July over last year, far worse than the forecasted 1.5 percent decline. Producer price inflation slipped to its lowest level since October 2009, down 5.4 percent year-over-year compared to the 5 percent drop expected and the 4.8 percent slide posted in June. Corporate profitability in China has been under pressure. And the Shanghai Composite, ahead of the move, had fallen nearly 30 percent from its June high.

In its statement, the PBoC explained that a strong currency was adding to the pressure on the country's exports. Since the yuan is loosely pegged to the dollar, the recent strength in the greenback has pushed the currency into overvalued territory, according to an analysis by Barclays.

Related: U.S. Stocks Can’t Keep Shrugging Off Global Pressures

While the move could help exports, the other consequences, such as capital outflows, reactionary devaluations from trade partners and possible credit market disruptions, are likely to come first. Moreover, while the devaluation was labeled as a "one-time" move aimed at enabling the market to better price the yuan, it's an open question whether further devaluations will follow as Beijing tries to merge its on-shore and off-shore currency markets.

For the U.S., a weakening of China's currency risks further strengthening the dollar, which would weigh on exports. It could also push down overseas corporate profits. Heading into the critical "hike/no hike" decision from the Federal Reserve next month, analysts are split on whether China's actions will sway the Fed one way or another, with some recommending that clients keep an eye on the movements of the U.S. dollar for clues. A rapid rise in the dollar would likely push the Fed toward a dovish stance, and a possible rate hike delay, since it would be disinflationary.

For now, though, the potential near-term negatives of a stronger dollar have spooked U.S. investors and pushed stocks lower. Technology stocks were under pressure Tuesday, falling 1.7 percent as a group. Apple (AAPL) fell 5.2 percent, its largest one-day loss since January 2014, on concerns over further damage to its business in China after poor quarterly results in late July and recent headlines that its iPhone market share had fallen to third place in the Middle Kingdom. Materials stocks, especially base metal names, were also hit with U.S. Steel (X) down 8.9 percent and Alcoa (AA) down 6 percent.

Related: The Stock Market’s Darlings Are Diving into Downtrends

Technically, stocks are on the precipice, with the S&P 500 poised to break below its 50-week moving average — a level that has sustained the stock market's rise since 2011. Remember that we haven't seen a correction of 10-plus percent since 2012.

Given that market breadth, or the percentage of stocks in uptrends, has been deteriorating for months, a deeper decline looks likely. The S&P 500 has been held in stasis thanks to the heroic efforts of a narrowing group of winners such as Facebook (FB).

Jason Goepfert at SentimenTrader notes that the result has been an increase in the number of "split days," in which there are an abundance of stocks making new 52-week highs and 52-week lows — one of the components of the much maligned "Hindenburg Omen" technical signal. The last two times there were a large number of split days combined with a death cross on the NYSE Composite were in 2000 and 2008, with no false signals in between.

Split days occurred in a similar magnitude to what we've seen so far this year in March 1968, August 1972, October 2000 and July 2006. In all four cases, stocks lost more than a third of their value at some point during the next two years.