The rebound is here.

U.S. stocks powered to a second straight day of strong gains, lifting the Dow Jones Industrial Average out of the red for the week. But the evidence suggests that despite hopes of a "V-shaped" face-ripping rally, this is a prototypical "dead cat" bounce and should be treated with skepticism.

In the 48 hours following Tuesday's late session meltdown, the Fed has moved in to calm nerves and elevate stock prices — proving once again that equity prices are a key concern for policymakers (despite their pleas that policy is set based on economic data alone).

On Wednesday, New York Federal Reserve Bank President William Dudley lowered expectations for a September interest rate hike, noting that the evidence was "less compelling" given recent financial market turmoil. This flies in the face of comments last Friday from St. Louis Fed President James Bullard that the Fed does not react directly to equity markets.

But the fundamentals make it difficult to summarily dismiss a September rate hike. And thus, the big negative catalyst that has pushed the Dow down nearly 1,800 points from its May high remains in play: The specter of the first increase in interest rates since 2006.

Related: The Troubling Truth Revealed by the Stock Market’s Nosedive

On Thursday, second-quarter GDP growth was revised upward to a 3.7 percent seasonally adjusted annual growth rate, up from an initial estimate of 2.3 percent, as consumer spending and housing turned out to be stronger than expected.

Crude oil is rallying strongly as well on reports that Venezuela is requesting an emergency OPEC meeting and is looking to possibly coordinate with Russia to address declining energy prices — potentially helping inflation move back towards the Fed's 2 percent target. And Treasury bonds are under pressure on reports that Chinese authorities are selling to raise dollars needed to stabilize their currency, the yuan, in the foreign exchange market. As a result, long-term yields have been on the rise this week despite the turbulence in the stock market, a reversal of the usual relationship.

There are technical reasons to be cautious as well. For one, the S&P 500 is on the verge of its first "Death Cross" — a move by the 50-day moving average below the 200-day moving average — since 2011. This is a sign of a clear deterioration in the market's medium-term trend strength. The Dow Jones Industrial Average suffered a death cross earlier this month. Volatility expectations, as measured by the CBOE Volatility Index (VIX), also suggest the selloff isn't over yet.

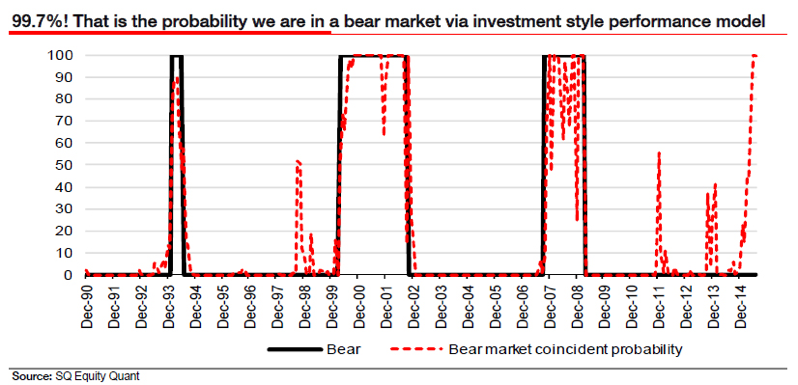

Societe Generale's Albert Edwards, a strategist known for his bearishness, also notes that there is a high probability — 99.7 percent! — that we are already in a bear market. That number is based on the findings of a model that looks at the performance and momentum of high-quality stocks. When investors are aggressively bidding up a narrowing list of good stocks (based on balance sheet measures) while ignoring the rest, it typically indicates a period of broad market underperformance.

Related: Why You Should Ignore the Stock Market Sell-Off

Finally, market history suggests caution as well. Jason Goepfert at SentimenTrader notes that when the S&P 500 posts a reversal like we've just seen — the best one-day gain in more than three years shortly after the worst one-day loss in three years — returns have tended to be underwhelming in the weeks that followed. On average, stocks were down nearly 6 percent one month later. The last occurrence was in September 2008, on the eve of the financial crisis. The index went on to lose 25 percent in the month that followed.

As they say: Buyer beware.