The U.S. economy has dropped a gear.

Pressure had been building for months, from weakness across Asia and Europe to the drag from low commodity prices and the hit to trade from a strong dollar. As a result, the September jobs report, trade balance, regional Fed manufacturing surveys and inflation have all disappointed. Expectations for a Federal Reserve interest rate hike have been pushed back to March 2016 or beyond according to futures market pricing.

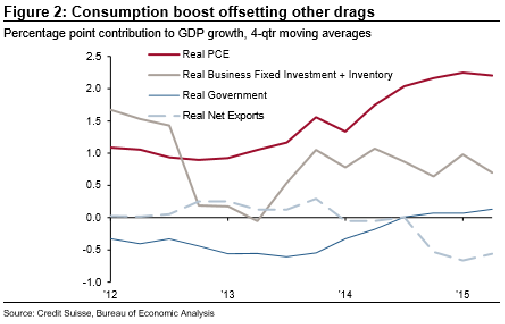

Yet GDP growth has been solid, with second quarter growth coming in at a seasonally adjusted annualized rate of 3.9 percent — the best result since the third quarter of 2014 — thanks to a heroic effort by consumers. A bounce back from the current funk will depend on continued strength by shoppers.

Are they up to the task?

Related: Holiday Shopping — Good for the Economy, Bad for Employers?

While much was made of the relatively weak U.S. retail sales data last week, with sales ex-autos, gasoline and building materials down 0.1 percent over August, Capital Economics notes that third quarter inflation-adjusted consumption growth is still clocking in at about a 3.0 percent annualized rate — not quite the 3.6 percent rate they were previously expecting, but "still healthy enough" in their words.

Analyst Philippa Dunne at the Liscio Report also notes that the year-to-date gain in retail sales ex-autos, gas and building materials is 4 percent, admittedly nothing like the 8 percent nine-month gain in this measure back during the housing boom of 2005, but still pretty solid. Especially when compared to the 2009 financial crisis nightmare, when the nine-month change was -7 percent.

The strongest spending growth is concentrated in bars and restaurants (with spending on food away from home now eclipsing spending on groceries for the first time) and auto sales, followed by sporting, hobby, books and music stores and furniture. Electronics stores remain negative at -1.9 percent for the year.

According to Dunne, sales of Apple's (AAPL) iPhone 6S will likely pop up in the October sales report because of quirks in the data. Something to look forward to.

The stakes are high.

The chart above from Credit Suisse shows just how reliant overall economic growth is on consumer spending, with real personal consumption expenditures by far the single largest contributor to GDP since late 2012. Credit Suisse economists believe the surge in spending over this time has been driven by several important and sometimes overlapping catalysts. For one, the drop in energy prices has amounted to about 1 percent of disposable income, according to their estimates. With the personal savings rate dropping lower recently, it appears the gas savings windfall is largely being spent — with much of it appearing to go into restaurant sales.

Related: 10 Jobs With the Biggest Raises

Two, while credit growth isn't surging, it appears consumers have stopped paying down debt as aggressively. Data from the New York Fed show household deleveraging largely stopped in late 2013 before the spending began its upward swing. A resumption of borrowing, according to Credit Suisse, has been broad-based, occurring across credit types, creditworthiness and geographical areas.

Three, the recession-related drop in consumption was most acute in areas of the country hardest hit by the housing downturn. This was driven by the big drop in employment in these areas as construction activity slowed, home equity withdrawals stopped and foreclosures set in. Since late 2012, the employment gap between areas of the country hardest hit by the housing downturn and those relatively unscathed has been rapidly narrowing.

That's a sign that, nearly 10 years on, much of the damage from the housing bust has finally healed.

And finally, there has been improvement in cash flows and income derived from labor among the lower- and middle-income portions of households — folks hit hardest in the recession and the slowest to benefit from the recovery.

Related: Why We Might Be Headed for a Recession in 2016

The wealthy drove consumer spending in the early stages of the recovery. Now, with income growth broadening, we're seeing a pickup in services and nondurable goods spending from those of more modest means.

Credit Suisse's Jay Feldman believes the data suggest "a larger share of households are benefiting from the recovery, which provides a measure of resilience."

Still, challenges loom.

Car sales are likely growing at an unsustainable pace (Feldman notes "no tree grows to the sky"). Monetary policy will eventually become less accommodative, threatening credit growth. And interest rate hikes could result in stock market volatility, dampening confidence, especially among the wealthy (with the top 20 percent of income earners responsible for 40 percent of durable goods purchases).

But for now, at least, things are looking good thanks to spendthrifts with flush pocketbooks.