Equities collapsed on Thursday and have continued to tumble on Friday, erasing Wednesday's meltup following the Federal Reserve's decision to raise interest rates for the first time in nine years.

I guess 24 hours is the time it takes for the bulls on Wall Street, who have been using a very narrow group of stocks to hold the overall market aloft, to realize that the start of the Fed's first policy tightening campaign in 11 years isn't exactly a positive catalyst. We'll know more next week as the inter-bank lending rate starts drifting higher, potentially revealing areas of vulnerability in the credit markets.

For now, the stage is set for a quick drop back to the August-October lows. Here's why.

Related: The Fed Just Raised Rates. Here’s What It Means for Your Money

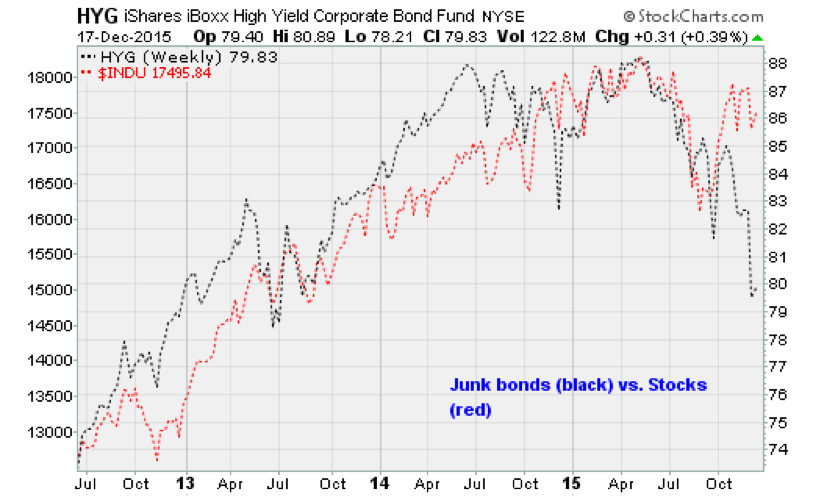

The big drag on Thursday was the resumption of selling pressure against high-yield "junk" corporate bonds after a number of analyst notes highlighted concerns in these areas.

Remember, the cycle is feeding on itself now: Steady job gains and a stabilization of inflation have pushed the Fed to hike, which is strengthening the dollar and weighing on energy prices. The combination of currency effects and lower commodity prices is also weighing on corporate earnings growth: S&P 500 earnings are expected to drop again this quarter, the third consecutive quarterly decline — something not seen since the financial crisis.

Lower profitability and higher interest rates are toxic to the junk bond market, where trading volumes are light (a consequence of years of ultra-low interest rates) and any price weakness is magnified as a result. The Barclays High Yield Bond ETF (JNK) lost 1.1 percent, leaving it trading at levels last seen in 2013. A similar drop in the Dow would take it back below the 15,000 level — a 14 percent drop from here.

Technically, stocks are a mess right now.

The Russell 2000 is down nearly 6 percent for the year-to-date as stocks like Amazon (AMZN) and Facebook (FB) are all that's preventing the major market averages from joining pretty much every other asset class to the downside. Small-caps, utilities and transportation stocks are significantly weaker. Commodities are a fallout zone. Fixed-income is being hit. Emerging market stocks are mired near their August-October lows.

As the calendar flips into 2016, analysts like Alberto Gallo, the head of global macro credit research at RBS, are worried that the Fed will have a tough time living up to its four-hike forecast. And even that pace represents just half of the tightening the Fed maintained during its last three hiking cycles.

Related: The 3 Biggest Winners from the Fed’s Rate Hike

Market-based expectations remain much slower, with only about two hikes priced in for 2016. The more the Fed's hawkish outlook is reinforced by steady job gains and an upward progress in inflation, the more high-yield bonds and equities will come under pressure.

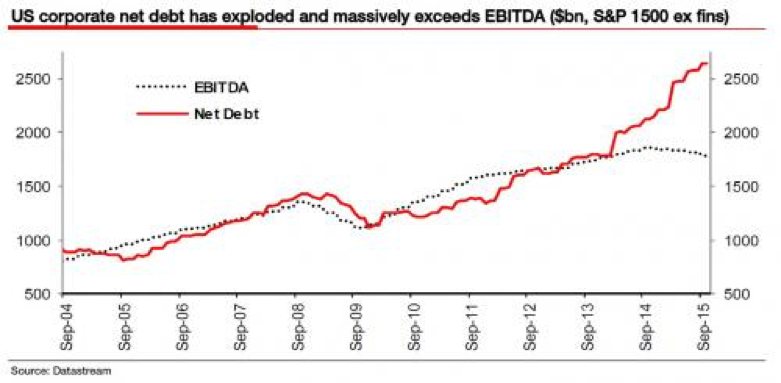

Societe Generale's bearish strategist Albert Edwards criticizes the Fed for waiting too long to start weaning the market from its monetary morphine. Plainly said, he thinks the "Yellen Fed will go down in infamy as deliberately stoking up yet another massive financial bubble. But unlike the start of the last tightening cycle in 2004, this time the corporate bond market is already severely stressed and it may take just a tiny pin-prick to burst open the putrid excess."

The borrowing was largely used to fund debt-fueled stock buybacks, which artificially inflated share prices while leveraging up corporate balance sheets — making them much more sensitive to a slowdown in earnings growth and an increase in credit costs — as the increase in debt outpaced operating earnings.

The outcome won't be pretty, as the consequences of the Fed's gradual rate hikes slowly tighten the noose: "The party's over and bond investors, who always tend to be more sober types, realize this and have headed for the exits whereas equity investors are so intoxicated they haven't realized that the music has stopped,” Edwards wrote to clients this week. “Equity investors are still gyrating around the dance floor — just as in 1999 and 2007."