The super-hyped meeting in Doha, Qatar, between OPEC and Russia has come and gone without a deal — a deal that was supposed to freeze output at January levels in an effort to bring an oversupplied global energy market back into balance. And yet, in a violation of all conventional logic, oil prices have held firm.

Drivers have no doubt already noticed the 70 percent rise in wholesale gasoline prices from the February low. Can prices stay at these levels?

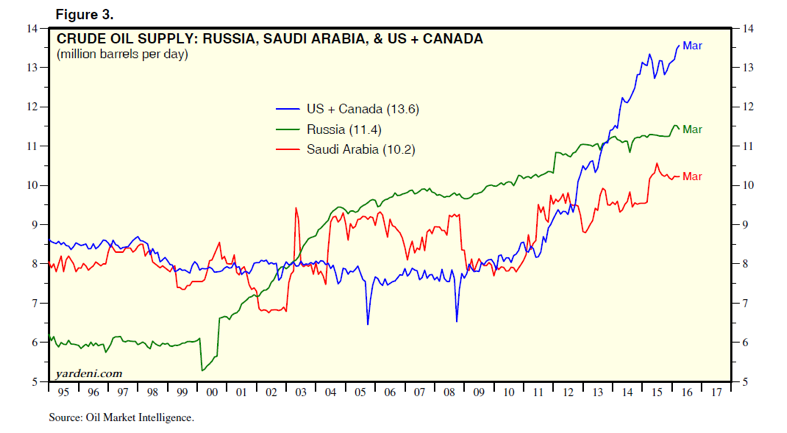

The stability comes despite comments from Russian Energy Minister Alexander Novak that the oversupply may last until the middle of next year. Saudi Deputy Crown Prince Mohammed bin Salman said that if a freeze deal isn't reached "we will sell at any opportunity we get," adding that the kingdom could increase output from 10.2 million barrels per day to 12.5 million in six to nine months "if we wanted to."

Related: Why the Doha Oil Meeting Was a Dud — and What It Means for Stocks

On Wednesday, Iraq's Deputy Oil Minister said that OPEC members and other producers were planning to meet in Russia in May to try to revive the proposed production-freeze agreement. Yet the Russian energy minister expressed doubt any deal could be made and added that Russia hasn't been invited to OPEC's next scheduled meeting in June.

The problem remains Iran, which is committed to increasing production from 3.3 million barrels a day currently to a pre-sanctions level near 4 million barrels. For Saudi Arabia, which torpedoed energy prices in 2014 in an effort to recapture market share from U.S. shale oil producers and is no friend of Tehran for religious and regional power issues, this is a nonstarter.

For now, however, the prospect of a miracle agreement is enough to keep oil markets in stasis. But based on supply, demand and inventories, I don't think the ebullience will last.

Consider that production is up across the board. According to data compiled by Oil Market Intelligence, oil output from the U.S. and Canada rose to a record 13.6 million barrels per day. Russian and Saudi production remains in record-high territory at 11.4 million and 10.2 million barrels per day. Same story with Iraq's production, at 4.3 million barrels per day. Iran, as mentioned above, is ramping up.

Related: Which Money Worries Keep You Up at Night?

Despite a collapse in U.S. drilling rig counts, and the fact that oil patch bankruptcies (totaling nearly $40 billion in debt over the last two years) are rising fast, the long-awaited drop in American oil output just isn't happening in a big enough way. According to data from the U.S. Department of Energy, U.S. crude production is down to 9.0 million barrels per day from a high around 9.6 million barrels.

This is coming at a time when inventories continue to swell, with stockpiles up 10.1 percent over last year.

And while global energy demand hit a new record high in March, the rate of growth slowed to just 1.4 percent over the latest three-month period. Crude oil supply rose at a 2.3 percent rate over the same time.

In trading on Thursday, West Texas Intermediate crude oil tested a high of $44.49 — a level not seen since last November. Given the all-in cost for U.S. shale companies is between $45 and $50, any rally into this area will be self-limiting because these folks will "increase spending, drilling and, after a time lag, production," according to Michael Haigh, the global head of commodities at Societe Generale.

Ed Yardeni of Yardeni Research notes that many U.S. oil frackers have DUCs — "drilled but uncompleted" wells — that can be quickly put back into service should prices stay high.

A few other points of note. Jason Goepfert at SentimenTrader finds that the two strongest months of the year, historically, for crude oil are March and April followed by a flat performance through the summer.

Related: The End of the Great American Oil Boom

Moreover, commercial oil hedgers in the futures market — commonly believed to be "smart money" traders often connected to energy companies — have worked off a bullish position accumulated back in February as oil was bottoming. Their positioning has returned to levels last seen during the April-June 2015 period when crude oil was consolidating tightly near $60 before suffering a wipeout starting in July.

All things considered, either American drivers hit the road like never before and boost demand or oil prices are headed for another fall.