On the surface, stocks can hardly contain their excitement in the wake of Donald Trump's surprise electoral victory.

The Dow Jones Industrial Average and the Russell 2000 small-cap index have both gone vertical, enthused by the promise of Trump's aggressive fiscal stimulus plans, including deep tax cuts, boosted defense spending and pro-business initiatives such as a possible repatriation holiday to encourage the re-shoring of foreign earnings. The U.S. dollar has been flying high as well, rising to 14-year highs.

But many other assets types have been absolutely hammered — including bonds, precious metals, foreign stocks and yield-focused equities — forcing investors to scramble to chase the performance. The result has been a worrisome narrowing of measures of market health, potentially threatening the entire post-election rally.

Related: Why Wall Street Should Be Worried About Steve Bannon

Breadth has been extremely narrow as many of the most popular names — especially big-tech stalwarts like Apple (AAPL) and Facebook (FB) — not only haven't participated but have been hit with selloffs. Same with yield-sensitive stocks such as telecoms, REITs and utilities.

Consider that there were only 146 net advancing issues on the NYSE during Thursday's advance, down from a high of roughly 2,000 on the Monday surge before Election Day. Or that just 62 percent of the stocks in the S&P 500 are in uptrends vs. 80 percent back in April. Or that there is a disturbing number of stocks making new lows right now, suggesting a market suffering a bout of schizophrenia.

Researchers at LPL Financial noted that something happened last Monday that's never happened before: More than 300 issues on the NYSE made new 52-week highs while more than 300 issues also made new 52-week lows. This reflects the weakness in the bond market, as debt-like instruments and debt-like stocks have been hit.

This is a marked change from the "buy everything" situation investors have enjoyed in recent years thanks to aggressive cheap money stimulus by the major central banks mixed with low inflation.

Related: 4 Reasons Trump’s Economic Policies Would Be a Disaster

Many have forgotten what the sting of asset price declines feel like. And if you were holding a bond-heavy or yield-focused portfolio heading into Election Day, you are feeling that sting now — and likely also feeling the urge to cut your losses and sell, which will magnify the pain for others. A cascade effect could result.

Similar post-election volatility is hitting other areas as well, including emerging market currencies and stocks. The iShares MSCI Emerging Markets ETF (EEM) has fallen roughly 9 percent from its pre-election high, testing its 200-day moving average for the first time since July. China's currency was revalued to lows not seen since 2010 last week. The Mexican peso is a disaster.

While these problems seem far removed, remember that Chinese market volatility slammed U.S. markets in August 2015 and again earlier this year. The U.S. does not trade in a vacuum.

The latest Flow Show report from Bank of America Merrill Lynch backs all this up, showing we've just experienced the largest equity fund inflow in two years ($28 billion), the biggest bond outflow in three-and-a-half years ($18 billion) and the widest weekly disparity between stock and bond flows ever.

Related: Why Trump May Leave the Federal Reserve Alone – for Now

Analysts wonder if the market panic following the surprise Brexit vote in June marked the "5,000-year low in global interest rates” and if “Trump marked [the] moment investors started to position for [a] bond bear market." The shift, if this is indeed a long-term inflection point, has a long way to run: Over the past decade, $1.5 trillion has flowed into global bond funds while global equity funds have been flat.

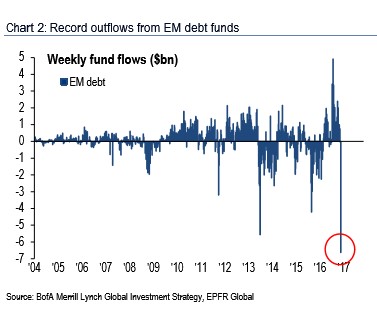

The "violent rotation" they noted was seen in other areas as well. Financial stocks enjoyed a $7.2 billion inflow. Materials enjoyed the largest inflow in three years. But precious metals suffered the largest outflow in more than three years and emerging market stocks saw the most severe outflows in 14 months.

The moral of the story: As the era of ultra-cheap money ends, investors will need to manage the mix in their portfolios. The past week has been a dramatic preview of this dynamic.